Annex Bulletin 2012-01 January 19, 2012

A partially OPEN edition

Oracle Runs Out of Oracles (Analysis of latest quarterly results)

INDUSTRY EARNINGS ROUNDUP

Updated 1/19/12, 10:00PM HST

Analysis of IBM's & Other IT Leaders Fourth Quarter Business Results

Apple, IBM Clean Up, Google Stumbles

Meet new king of IT; Microsoft leapfrogs over IBM, Google also behind

Preview - Before the Earnings Releases

HAIKU, Maui, Jan 19, 2012 - Today, Jan 19, is "Judgment Day 2011" for five major global IT leaders. IBM, Apple, Google, Intel and Microsoft are due to release their calendar year 2011 business results after the markets close later today. When it comes to companies like IBM, typically, a good tactic at this point in the cycle has been "buy on rumor, sell on fact." Meaning, this would be a good time to sell, before the facts are known. Not today. IBM stock has been zigging lately while the market and its major rivals have been zagging.

Take a look at the charts...

Big Blue shares have declined since the start of the year, while the market and other IT leaders' have moved up.

A full year comparison between IBM and the market can help explain the reason. The IBM stock has run ahead of the market in 2011, just as we noted in our early Dec 2011 analysis of the global IT leaders. So what has happened in the last six weeks or so is a "correction" to bring Big Blue closer line with the rest of the market.

No such worries seem to exist on Wall Street when it comes to Apple. Like IBM, Apple had also run ahead of the market. But unlike IBM, Apple continues to do so, after a brief respite in November.

Meanwhile, IBM's fundamentals seem as solid as ever. So we expect to see Big Blue shares rejoin other Wall Street leaders again in the near future. As a result, "sell on rumors, buy on facts" may be an appropriate stance today with respect to IBM stock.

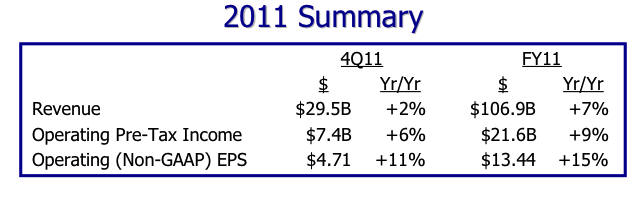

Here are some charts about the fourth quarter and the full year 2011...

4Q Business Segment Highlights

- Continued momentum in Software: Revenue +9%, Profit +12%

- Services revenue +13% @CC; Services Profit +17%

- Continued strength and share gain in Power Systems

Analysis - After the Earnings Releases: Why Wall Street Should Trust IBM

Okay, let's put some more flesh on the bones of this story...I'll spare you the details. You can read how IBM did in individual product lines in any other business media story and see the charts below. I'll try to give you a high level view of why IBM deserves to be trusted in the future even though its shares have already outperformed the market in the last 12 months:

-

IBM makes markets that others then try to follow. Smarter Planet is one case in point. Cloud computing is another. Business analytics, which is really a derivative of the other two, is yet another example.

BENEFIT to IBM: Smarter Planet grew 47% in 2011, Cloud tripled its revenues over 2010, Business Analytics rose 16%. IBM as a whole grew 7% for the year. So now you can see three major "growth engines" that are driving the business increases.

-

IBM also practically invented what is now known as "growth markets" (we used to call the "emerging markets"). They have become another growth engine for Big Blue. In 2011, they were up 16%, more than double the overall growth.

BENEFIT to IBM: The "growth markets" now account for two-thirds of the company's revenue growth.

-

Over the years, IBM has struggled in what we used to call "SMB" market (small and medium size businesses). A few years ago, the company renamed this part of its business to GB (General Business). Well, looks like in 2011, IBM found the way of making that into a growth engine, too. The GB revenues were up 7% in the fourth quarter vs. 2% for the corporation as a whole.

BENEFIT to IBM: Diversification away from the "Fortune 500"-type companies which are laggards when it comes to growth. Just think Kodak, for example (you'll see more on that in our actual Annex Bulletin story).

-

Solid track record. IBM has now had nine consecutive years of double-digit earnings growth. When it some to Corporate America, things don't get more consistent than that. So the company's track record is another reason investors can trust it in the future, too.

But the main reason, and the single overriding argument why investors should trust IBM is that the 100-year old company keeps reinventing itself practically every day of every year. Like life itself, this is a company in continuous motion. IBM of 2012 is vastly different company than was Big Blue of 2002, the year Sam Palmisano ascended to the position of CEO. Like everything else in the universe, you change one step and one day at a time. That's the secret to IBM's success. That is the reason the company has been outpacing the US GDP by almost two-to-one for over a century.

"Sell on rumor, buy on fact." And now we know the facts behind the rest of the Big Blue story. Have a nice evening.

Apple Earnings Go Through the Roof on Holiday iPhone Sales

Apple Inc. reported this evening that earnings surged 118% for its first fiscal quarter, mostly on strong sales of the iPhone. For the period ended Dec. 31, Apple reported net income of $13.1 billion, or $13.87 per share, compared to net income of $6 billion, or $6.43 per share, for the same period the previous year. Revenue jumped 73% to $46.3 billion.

Analysts were expecting earnings of $10.08 per share on revenue of $38.85 billion for the quarter, according to consensus forecasts from Thomson Reuters.

For the current quarter, Apple projected revenue of $32.5 billion with earnings per share of $8.50, adding that the quarter includes 13 weeks. Analysts were expecting revenue of $32 billion with earnings per share of $8.02, according to consensus forecasts.

Microsoft shares rise 2% after earnings meet expectations

Microsoft reported a fiscal second-quarter profit of $6.62 billion, or 78 cents a share, on revenue of $20.89 billion. During the prior-year's quarter, Microsoft earned $6.63 billion, 77 cents a share, on $19.95 billion in sales. Analysts surveyed by FactSet Research had forecast the software giant to earn 76 cents a share on $20.9 billion in revenue.

Intel reports 6% higher profit, exceeding estimates

Intel Corp. reported a fourth-quarter profit $3.4 billion, or 64 cents a share, compared with its profit of $3.2 billion, or 56 cents a share, in the year-earlier period. Revenue rose 21% to $13.9 billion from $11.5 billion. Adjusted income was 68 cents a share. Analysts had expected the Santa Clara, Calif.-based semiconductor company to post earnings of 61 cents a share, on revenue of $13.7 billion.

Google disappoints despite increase in earnings

Google Inc. reported a 6% gain in fourth-quarter earnings this afternoon, missing Wall Street's expectations. For the period ended Dec. 31, Google reported net income of $2.71 billion, or $8.22 per share, compared to net income of $2.54 billion, or $7.81 per share, for the same period the previous year. Net revenue, excluding traffic acquisition costs, came in at $8.13 billion. Analysts were expecting earnings of $10.51 per share on net revenue of $8.43 billion,

The Day After: "Buy on Rumor, But Even More on Fact"-Tactic

HAIKU, Maui, Jan 20 - And now, here's what happened "the day after"...

Wall Street loved what it saw and bid up both IBM and Apple shares. So "buy on rumor and sell on fact"-tactic did turn out to be appropriate this time around. Except, an option play is also "buy even more" on fact instead of selling. Just a thought... :-)

As for Google, as a result of this perceived "miss," Google shares were off 8% in premarket trading on Friday after the Mountain View, Calif., web-search firm reported that fourth-quarter earnings rose 6% but missed analysts' forecasts. Google executives attributed the earnings miss to a number of factors, including foreign-currency translations and an impairment charge. Operating expenses also were heavy, up 35%, as the company added more than 1,000 staffers. On the upside, paid clicks -- the number of times Google users click on the firm's ads -- rose 34% in the quarter.

Happy bargain hunting

Bob Djurdjevic

![]()

Volume XXVII, Annex Bulletin 2012-01 Bob Djurdjevic, Editor

(c) Copyright 2012 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2012 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

Happy Birthday, IBM! (IBM to turn 100 on June 16; what's the secret of its success?)

Apple Falls from Tree to Cloud, Then to Earth... with a Thud (Last major holdout joins race to cloud, but falls flat on first attempt)

Annex's 33rd Birthday (May 15, 2011)

Big Blue "Rock of Gibraltar" Stands (Analysis of IBM's first quarter business results)

Wall Street's New "Rock of Gibraltar" (Annual update to our 5-yr IBM forecast)

HP: Ghost of EDS Haunts HP (Analysis of HP's first quarter 2011 business results)

Case Makes a Case for Innovation (Analysis of new "Startup America" program)

HP: New Broom Sweeps Clean (Apotheker fills our first prescription in board shake-up)

IBM: Another Phoenix of the IT Industry , Analysis of IBM's 4Q10 result

One Man's Pain, Another Man's Gain? (Analysis of possible impact of Steve Jobs' health on IBM, Intel, other IT companies)

Consumer Rules (Analysis of top 15 global IT leaders' stock and business performances)

IBM Hardware to Rise and Shine Again (Analysis of IBM STG business results and outlook)

BARRON's: IBM Shareholders Will Like New Year (Analysis of Barron's article on IBM stock)

HP's "Stealth CEO" Sounds Bullish in First Public Appearance (Analysis of HP's fourth quarter business results)

Silicon Valley Rodeo (Editorial on shenanigans and costly trivial pursuits)

IBM Business Up, Stock Down (Analysis of Big Blue's third quarter business results)