|Annex Research | Annex Bulletins | Quotes | Workshop | Feedback | Clips | Activism | Columns |

Also, check out: "Compaq's Rockwell Modems May Rock Well, But That's About All They Do Well," "Was Compaq's Presario Pressed into Service Too Soon?", "ComDec to Boost Wintel?"

![]()

The copyright-protected information contained in the ANNEX BULLETINS is a component of the Comprehensive Market Service (CMS). It is intended for the exclusive use by those who have contracted for the entire CMS service.

PCs & WORKSTATIONS

Analysis of Dell's Fourth Quarter and Full Fiscal Year '99 Results Easy Come, Easy Go Outstanding Business Results Not Enough; $49B of "Fluff" Value LostPHOENIX, Feb. 18 - The latest business results by Dell Computer Corp. were nothing short of outstanding. Its fourth quarter net earnings were up by 49%; revenues surged by 38%; operating margins hit a record high of 11.5%.

And while its competitors, like IBM and Compaq, spent millions of dollars advertising the "e-commerce" idea, Dell was practicing what they preached. In the fourth quarter alone, the company booked $1 billion in customer sales through its Web site. At $14 million per day, the rate with which Dell closed out its calendar year 1998, Dell's Internet sales amount to $5 billion per year.

For the full fiscal year '99, which ended January 31, Dell's net profit was up by 55%, a 10-fold surge in just four years, as this PC maker tore through its first billion-dollar year like a shinkansen ("bullet") train through a papier mâché barrier (the FY99 net was $1.5 billion, up from $944 million in FY98). Its FY99 revenues surged by 48% to $18.2 billion.

To put things in perspective, when this decade started, IBM's PC sales were $9.6 billion, about 25 times greater than Dell's ($389 million in 1990). Now, Dell is almost 50% bigger than IBM's PC unit. And Dell's fastest growth is coming right from the Big Blue backyard - IBM's cherished blue ship "enterprise accounts." Dell's sales of enterprise servers surged by 119% in FY99 to $2.2 billion, nearly a 10-fold jump in just two years.

In other words, Dell is eating everybody's lunch, but most of its nourishment seems to be coming from the former patrons of the IBM PC kitchens.

Thumbs Down on Wall Street

Despite such stellar business results, Wall Street gave Dell thumbs down upon the release of its fourth quarter financials. In fact, Dell was blamed today in a Wall Street Journal report for pulling down the entire stockmarket, including the Dow Jones industrials. Yet most of the Dow Jones industrials are Dell's best customers, not competitors (see "Dell Report Sends Stocks Down 101.56").

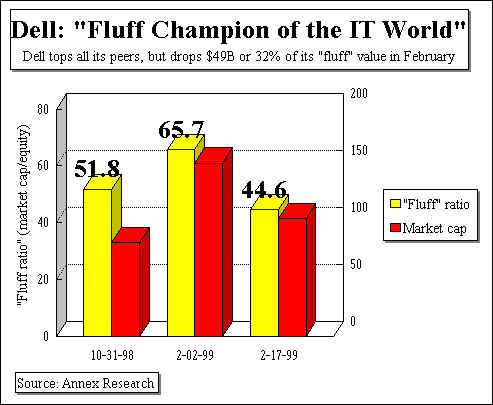

The drop only starts to make sense if one considers that the dramatic rise of Dell's "fluff ratio" over the last three months (market cap over equity) made even less sense. So, in a way, the market was correcting itself by letting some of the hot air out of the overheated stocks, like Dell.

Meanwhile, the stockmarket's "irrational" reaction underlined one of our long-standing arguments - that there is little rationality anymore in the way Wall Street assesses the values of companies, its computer models notwithstanding. It's strictly a game of cashflows (money available to invest in stocks). And hype, with some companies buying Wall Street's recommendations with their multi-billion dollar stock buybacks programs. Lest you forgot, last fall, we anointed Dell as the "Fluff Champion of the IT World" (see "Corporate 'Cabbage Patch' Dolls," Annex Bulletin 98-39, 10/31/98).

During Dell's FY4Q, the stockmarket padded Dell's "cabbage patch" doll with some $70 billion-worth of more "fluff." In return, Dell lined Wall Street's pockets with proceeds from handling the repurchases of 15 million shares. But $49 billion of market cap has now disappeared, in just the last few days. Easy come; easy go.

For the last three years, we estimate that Dell has spent over $3.1 billion on stock buybacks. That's about 1.3 times its equity - also a record ratio among its IT industry peers!

But in return, Dell has been able to buy itself some $150 billion worth of "fluff" - excess of market capitalization over equity.

Insiders Sell

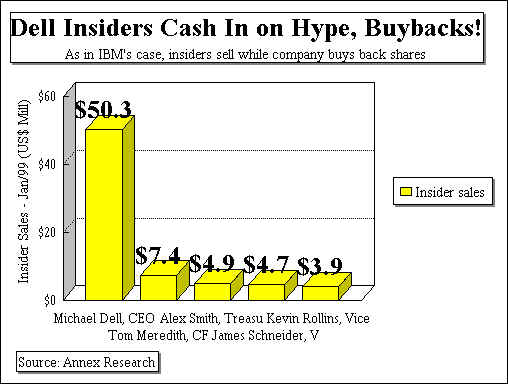

And just as in IBM's case, while their company was buying back its stock by the billions, insiders were selling by the tens of millions, cashing in on market gamblers' gullibility.

In January, in advance of the latest financial report, five Dell executives sold $71 million-worth of their stockholdings, according to a Feb. 12 Dow Jones Newswires report. Michael Dell, founder and CEO, topped the insider-sellers' list, cashing in on $50.3 million-worth of stock. He was followed by Tom Meredith, the CFO ($7.4 million); Alex Smith, the treasurer ($4.9 million), James Schneider, VP of finance ($4.7 million), and Kevin Rollins, vice chairman ($3.9 million).

Funny how it sounds all too familiar with the moves which IBM's Lou Gerstner and his lieutenants had made after hyping up the IBM stock, and spending tens of billions of dollars of the shareholders' money on stock buybacks (see "Where Armonk Meets Wall Street, Greed Breeds Incest," Annex Bulletin 98-41, 11/27/98).

One argument in Dell insiders' favor, however, is that at least they also delivered outstanding business results to their shareholders, rather than the mediocre ones, like Armonk's apostles of greed, most of whose businesses are flat or shrinking.

But the worst is not over yet; not even for Dell. For, even after the latest Dell stock price "correction," which purged some 32% of Dell's market value since February 2, at the stock price of about $82 per share, Dell has over $100 billion of "fluff" left in its share price, or 98% of its market cap. And with its current 44.6 "fluff" ratio, this PC maker still continues to be the "Fluff Champion of the IT World" - by a country mile.

A Market Perversion

What we are trying to say is that business excellence doesn't matter much when it comes to today's stockmarket. Nor does what kind of business a company is in.

Dell, for example, could have been dealing in dill pickles, indelible ink or snake oil, rather than in PCs - for all the difference that would have made to the Wall Street's casino players. The result would have been still the same. Because today's Wall Street is a game driven by rumors, investment cashflows, stock buybacks and electronically-created money, rather than by facts, business results and finite commodities, like gold.

Business executives who plan for the future, and those who plan to be around for a while, had better keep that in mind. And try not to succumb to temptations of easy money which is awash on Wall Street today, having bounced off the more perilous shores of Southeast Asia, Russia or Brazil.

As Dell has shown this week, easy comes; easy goes. In tens of billions of dollars. With more easy money to go; less to come in the future...

Happy bargain hunting!

Bob DjurdjevicAlso, check out... "Compaq's Rockwell Modems May Rock Well, But That's About All They Do Well," "Was Compaq's Presario Pressed into Service Too Soon?", "ComDec to Boost Wintel?"

Give us a call at: 602/824-8111 or send us an e-mail: annex@djurdjevic.com