Annex Bulletin 2008-18 September 15, 2008

A partially OPEN CLIENT edition

"Beat the Street" Drumbeat Continues (Analysis of HP's 3Q08 business results)

Big Blue Stock Sags on "No News" Days (Analysis of IBM institutional shareholdings)

EDITORIAL COMMENT

Updated 12/11/08, 10:30AM PDT, adds Consumer Debt Drops, Govt's Soars...

There Is No Such Thing As a "Free Lunch" in Truly Free Markets

Just Say NO to Greed 2 - Killer of Dreams!

Proverbial IT Babies Being Thrown Out with Wall Street Bathwater

|

"There is nothing new under the sun," King Solomon

declared over 30 centuries ago. "Laws are like spider webs. If some poor weak creature comes up against them - it is caught. But the bigger one can break through and get away," Greek philosopher Solon noted some 2,600 years ago. |

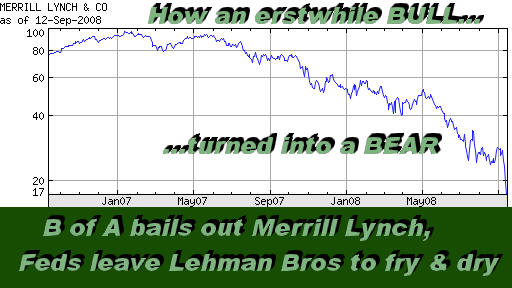

SCOTTSDALE, Sep 15 Well, there is nothing new under the Wall Street sun, either. The government keeps bailing out the big fish while letting the smaller ones to fry and dry. Over the weekend, the Feds engineered a private takeover of Merrill Lynch by Banc of America. They refused to save Lehman Bros which filed for bankruptcy this morning. New names, same old boardroom games (see below "Just Say No to Greed," Mar 2008).

State and federal government officials are also scurrying around trying to figure out how to save another financial whale, the insurance giant AIG. Why Bear Sterns, Merrill Lynch and AIG, but not Lehman Bros and scores of other smaller financial institutions that are failing? Good question. No logical answers from government officials.

Guess when a big whale gets beached and the carcass starts to rot, the stench can be smelled for miles around. Same on Wall Street. Washington doesn't want big carcasses piling up on the lower Manhattan beaches ("What beaches?", I suspect you may be asking. Well, there used to be some before big banks paved them over with fools' gold).

As a result, a state of panic on Wall Street has caused the Dow Industrial to plunge over 500 points as we speak. Which makes it about a 3,000-point stock market decline since early May.

The whole thing is nonsensical, at least in the IT sector. Even as IBM and HP keep on reporting stellar results (see IBM Delivers Explosive Quarter , July 2008, and "Beat the Street" Drumbeat Continues, Aug 2008), the jaded stock market traders keep selling off their shares along with those of the failing financial stocks. Ditto re. consumer-based Google and Apple stocks which have even less to do with the failures of the financial giants. So proverbial IT babies are being thrown out with the bathwater.

Again, nothing new under the Wall Street sun. So rather than repeat the comments we have already made six months ago about this financial crises, we'll incorporate them here by reference (see below).

Happy bargain hunting!

Bob Djurdjevic

![]()

Published 3/07/08, 2:00PM MST

There Is No Such Thing As a "Free Lunch" in Truly Free Markets

Just Say NO to Greed - Killer of Dreams!

We Must Stop Rescuing the Gullible and the Greedy and Put Them into Financial Rehab

SCOTTSDALE, Mar 7 Do you believe that there is a "free lunch," that you can get something for nothing? Or conversely, that you can get something OUT OF nothing?

If you believe the former, then you are a typical American consumer who took out a subprime mortgage when the rates were low (circa 2004-2005). If you believe the latter, you are a typical U.S. banker or a mortgage broker who created this financial out of thin air and greed.

Now, do you believe that greed can kill dreams?

If not, you're an ostrich. Take your head out of sand and look around.

All those thousands of foreclosures around th e

country are thousands of shattered dreams. One out of five of the

subprime loans were past due in the fourth quarter, while an additional 13%

were in foreclosure. It's the highest rate of foreclosures since 1985

(see the chart).

e

country are thousands of shattered dreams. One out of five of the

subprime loans were past due in the fourth quarter, while an additional 13%

were in foreclosure. It's the highest rate of foreclosures since 1985

(see the chart).

Now, what's are some COMMON elements in the above examples? First, both consumers and bankers had CHOICES. Each could have chosen NOT to take the road to doom and disappointment. But they didn't. Driven by greed and plied with a "free lunch" gullibility, they took the low road to gloom.

The second is that each of them was motivated by SELFISH goals. Consumers thought they could save money. Or buy things they could not afford. Bankers and mortgage brokers thought they could make money off of people whom they lured into debt they could not carry.

And now, both sets of culprits are turning to other people, like you and I, expecting us to bail them out. Do you think that's fair? More importantly, do you think that rescuing people like that from financial disaster will help them?

It will not. Not anymore than it would "help" to give alcoholic smaller shots of wine, or treat a drug addict with less cocaine than before. What greedy and indulgent people need to do is change their lifestyle and outlook on life. If we are to stay healthy as a society, we need to put people like that in financial rehab, not give them money so their problems would continue to fester. What we need to do is wean them off these bad habits and the sense of "entitlement" that they have built up. And we need to do that with some "tough love" methods, like those practiced in alcohol or drug-addition rehabs.

As for the "dealers," like the "get rich quick"-type bankers and mortgage brokers, let them bleed or go bankrupt. And put their CEOs' faces on billboards around the country for ridicule as examples of shysters who got ruined by Greed - their own.

Yet the President and the Congress and the Federal Reserve all feel the need "to do something." And they already squandered more than $100 billion of our own untainted money to try to help the "addicts" and the "dealers" continue with their bad habits.

Just yesterday, the government took a major step aimed at jump-starting the housing market by raising the cap on the size of mortgages that can be bought by government-sponsored mortgage giants Fannie Mae and Freddie Mac or insured by the Federal Housing Administration. The move was mandated by the recently enacted economic-stimulus law - read a Big Bailout.

Have we learned nothing from the "junk bonds" or the "S&L crises?"

Rescuing people who believe in a "free lunch" will only ensure that they try it again. It is time we, the American taxpayers, "Just say NO!" to both our government officials and the financial wizards who have cooked up this financial mess (as Nancy Reagan advocated for drug abusers back in 1986). Let them stew in their own stew. Once we have cleansed our economy of bad debt, more sound business practices will ensue.

The Latest Bad News

Well, that process seems to be under way. Home values declining rapidly. Last year marked the first time American homeowners in the aggregate owned less than half the value of their houses. Their share of home equity -- the market value of a home minus the size of its mortgage -- dropped to 47.9% in the fourth quarter of 2007, down one percentage point from the third quarter, the Fed said in a just-released quarterly report.

Equity as a percentage of home values has been falling from a high of more than 80% since 1945, when the data started being recorded, but that decline generally has been a result of mortgage debt rising faster than home prices.

Lately, the downturn in homeowners' equity has accelerated, and it is being driven by falling home prices, which is more ominous both for consumers' net worth and for the loans collateralized by those homes. The decline could portend an increase in the delinquencies and foreclosures that have roiled global credit markets. And the banks are now collecting less than 50% of their mortgage value through foreclosures.

"There are more homeowners who are getting pushed to the limit, where they have little equity left in their homes," J.P. Morgan Chase economist Michael Feroli told the Wall Street Journal. "That makes it difficult to refinance."

The Good News

The good news in all this bad news is that the universe is unfolding as it should. Free markets are doing what they are supposed to - punish the "get rich quick" schemes and reward virtue. The Gullible and the Greedy are being punished. The Patient and the Prudent are sitting on the sidelines, cash in hand, waiting for the right time to jump back in.

Our government leaders should practice what they preach, and STAY OUT of free markets. Free markets only remain free without government interference. So they should lead by example and "Just Say NO to Greed!"

I know, I know... That's a tall order in this Land of the Entitled that was once a Land of the Free. Still, I felt it needed to be said. So I'll say it again: "Just Say NO to Greed!" Lest you want your dreams to turn into nightmares.

Happy bargain hunting!

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

MARKET UPDATE: A RARE "I TOLD YOU SO" UPDATE

Walk the Talk? Not on Capitol Hill or White House

Screw Taxpayers to Help Bankers

Senate and House do what politicians get paid to do: Toe the line and screw taxpayers to help bankers

SCOTTSDALE, Oct 3 As our clients and

readers know, I profoundly detest "I told you"-pieces. Yet in the last

two days, several of you have urged me to run another update on the current

"financial crisis" and the Wall Street bailout. You argued that some of my

old pieces would be even more valuable now just because they had

predicted the use of taxpayers' money to shore up private banks.

Nor were these stories a week, or two weeks old, in reference to current affairs context. Some of them were written almost 11 years ago, when the Southeast Asia banking crisis swept the world. Check out "Wall Street's Financial Terrorism," for example, a piece that was also carried in March 1998 by CHRONICLES, a Chicago-based current affairs magazine.

"You might want to dust this off and bring it back out. Its still true," one reader wrote to me last night (Oct 2). I complimented him on long memories and good research. And so reluctantly, here it is again... "WALL STREET'S FINANCIAL TERRORISM," if you're interested.

Furthermore, about two weeks ago, when the news of the $700

billion-bailout first broke, I said to several friends, "just watch those

puppets in Washington stand on their soap boxes and talk up a storm about

protecting the taxpayers' interests. And then watch them vote to screw the taxpayers and

help the bankers."

Furthermore, about two weeks ago, when the news of the $700

billion-bailout first broke, I said to several friends, "just watch those

puppets in Washington stand on their soap boxes and talk up a storm about

protecting the taxpayers' interests. And then watch them vote to screw the taxpayers and

help the bankers."

When did you ever hear of a politician walking his talk? They all know what side their bread is buttered on and by whom. No wonder they also say that, "any time you hear a politician scream, you know someone has just told the truth." :-)

The $700 billion (and growing) bailout package is no laughing matter. It goes to confirm another old truism. They also say, "when you owe a bank a million dollars, the bank controls you. But when you owe a bank a billion dollars, you control the bank."

And what if a bank owes $10, $20, $50 or more billion dollars? Well, then it controls the government, as the votes in the Senate and the House have proven.

That's why I used the record 777-point drop after the first House vote as an opportunity to buy some undervalued stocks.

And what was the market reaction? A shrug. The Dow Jones index, which was up 290 points before the vote, declined to a level only 75 points than yesterday after the House vote became fact. And now (11:30 PDT), it is DOWN 14 point. This reconfirms another old adage - "buy on rumors; sell on facts."

Meanwhile, back to Washington, remember what I have been telling the media during the last several elections, when they asked me who I would vote for? (I replied, "anybody but a Republican or a Democrat"). That's because they are all horses sporting different colors but racing for the same stable owners (banks and big business).

"The Presidential Election '96 had all the excitement of a one-horse race, a big yawn!," I wrote in a 1996 column in Washington Times. Yes, folks, 12 years ago! (see "The American Century and Demo Farce", Nov 1996). But I also warned that, "real autocracy may follow the current 'demo farce'." Everything that's been happening since 9/11, including the latest Wall Street bailout, has the earmarks of a "real autocracy." Or more accurately, PLUTOCRACY (as I also wrote in March 1997 - see "Plutocracy of the New World Order").

If in doubt, just check out yesterday vote in the Senate that overwhelmingly (74-25) approved the bailout package. I've highlighted the prominent Democrats and Republicans [Obama, Clinton, Biden...(D); McCain, Lieberman, Bingaman... (R)]. They all voted the same way: Screw the taxpayers to help the bankers.

Well, as I said at the top of this piece, quoting King Solomon from 30 centuries ago, "There is nothing new under the sun."

* * *

Senate bailout vote

Wed Oct 01, 2008 at 06:10:01 PM PDT

Akaka - Aye

Alexander - Aye

Allard - No

Barasso - No

Baucus - Aye

Bayh - Aye

Bennett - Aye

Biden -

Aye

Bingaman - Aye

Bond - Aye

Boxer - Aye

Brown - Aye

Brownback - No

Bunning - No

Burr - Aye

Byrd - Aye

Cantwell - No

Cardin - Aye

Carper -

Casey - Aye

Chambliss - Aye

Clinton -

Aye

Coburn - Aye

Cochran - No

Coleman - Aye

Collins - Aye

Conrad - Aye

Corker - Aye

Cornyn - Aye

Craig - Aye

Crapo - No

DeMint - No

Dodd - Aye

Dole - No

Domenici - Aye

Dorgan - No

Durbin - Aye

Ensign - Aye

Enzi - No

Feingold - No

Feinstein - Aye

Graham - Aye

Grassley - Aye

Gregg - Aye

Hagel - Aye

Harkin - Aye

Hatch - Aye

Hutchison - Aye

Inhofe - No

Inoye - Aye

Isakson - Aye

Johnson - No

Kennedy - n/v

Kerry - Aye

Klobuchar - Aye

Kohl - Aye

Kyl - Aye

Landrieu - No

Lautenberg - Aye

Leahy - Aye

Levin - Aye

Lieberman

- Aye

Lincoln - Aye

Lugar - Aye

Martinez - Aye

McCain -

Aye

McCaskill - Aye

McConnell - Aye

Menendez - Aye

Mikulski - Aye

Murkowski - Aye

Murray - Aye

Nelson, FL - No

Nelson, NE - Aye

Obama -

Aye

Pryor - Aye

Reed - Aye

Reid - Aye

Roberts - No

Rockefeller - Aye

Salazar - Aye

Sanders - No

Schumer - Aye

Sessions - No

Shelby - No

Smith - Aye

Snowe - Aye

Specter - Aye

Stabenow - No

Stevens - Aye

Sununu - Aye

Tester - No

Thune - Aye

Vitter - No

Voinovich - Aye

Warner - Aye

Webb - Aye

Whitehouse - Aye

Wicker - No

Wyden - No

MARKET UPDATE 2: GOVERNMENT'S CHRISTMAS GIFT TO BANKERS

For the First Time in History...

Consumers Debt Drops, But Government's Soars

American Plutocracy Thriving: Taxpayers to Bear the Burden of Corporate Bailouts

SCOTTSDALE, Dec 11 At a first glance, the

story that crossed the wires around noon today looked like a first good news

story for American consumers in a

long time. It is not. Appearances can be deceiving. For,

the "Princes of the New World Order" have merely figured out a new way of

fleecing the taxpayers. First with the bankers', then with carmakers'

bailouts.

So what's the new story? For the first time in history, the U.S. households' debt has declined, the Federal Reserve reported this morning. Stung by the loss of $2.81 trillion in their net wealth, people paid down their debts in the third quarter for the first time since at least 1952, since such records have been kept.

But hold your horses. Put that champagne back on ice. Our shopaholic society can't be been cured so easily of a spending disease that took over half a century to develop. The U.S. central bank also reported that the debt taken on by the federal government soared by 39.2% to a postwar record. Which means the taxpayers are still stuck with a bill for all those corporate bailouts.

And now some details...

As of the end of the third quarter, the

American households' total outstanding

debt shrank a t

an annual rate of 0.8% from $13.94 trillion to $13.91 trillion, the Fed said

in its flow of funds

report. Consumers paid off more mortgage debt than they took on for the

first time on record. Mortgage debt fell

at a 2.4% annual rate to $10.54 trillion. But other consumer debts,

such as credit cards and auto loans, increased at a 1.2% annual rate in the

quarter to $2.6 trillion. Total U.S. domestic non-financial debt increased

at a 7.2% annual rate.

t

an annual rate of 0.8% from $13.94 trillion to $13.91 trillion, the Fed said

in its flow of funds

report. Consumers paid off more mortgage debt than they took on for the

first time on record. Mortgage debt fell

at a 2.4% annual rate to $10.54 trillion. But other consumer debts,

such as credit cards and auto loans, increased at a 1.2% annual rate in the

quarter to $2.6 trillion. Total U.S. domestic non-financial debt increased

at a 7.2% annual rate.

Which is hardly a cause of celebration. Except for bankers. First, they get the public funds to write off their bad debts. Then they get to make money on the loans to the public (i.e., government) to fund the bailouts. It's a win-win scenario for bankers, and a lose-lose deal for consumers.

As you can see, the American plutocracy is alive and thriving...

![]()

For additional Annex Research reports, check out... Annex Bulletin Index 2008 (including all prior years' indexes)

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXIII, Annex

Bulletin 2008-18 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 (c) Copyright

2008 by Annex Research, Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2008 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

![]()

IBM Delivers Explosive Quarter (Big Blue firing on all cylinders - analysis of 2Q08 results)

MacAttack Falters at Foot of Mount Vista (A story about yet another attempt to break away from Windows)

Minting "Green" into Greenbacks (An update to our five-year forecast for IBM)

Better Late Than Never - Analysis of a rumored HP takeover of EDS

IBM "Places" By a Nose over Google - Analysis of Top 20 IT Cos stock and business performances

Big Blue Takes Chill Off Wall Street's Spring (Analysis of IBM's first quarter business results)

Just Say NO to Greed - Killer of Dreams! (An editorial comment about subprime financial crisis)

The z10 Lifts "Big Green" (Analysis of IBM's new mainframe announcement)

HP Beats the Street Again (Analysis of HP's 1Q08 business results)

Capgemini's Great Valentine's Day Gift (Analysis of Capgemini's 4Q07 and FY07 results)

Profit Drops, Stock Follows (Analysis of EDS's 4Q07 results)

Profit, Revenue Surge, Lifting Stock, Too (Analysis of CSC's 3Q08 results)

Services, Emerging Markets Boost IBM (Analysis of IBM's full 4Q07 results)

Big Blue Shines in 4Q (Analysis of IBM's preliminary 4Q07 results)

Microsoft Still Wall Street Darling (Analysis of institutional holdings of Top 10 IT Cos)