Annex Bulletin 2010-17 November 23, 2010

A partially OPEN edition

Silicon Valley Rodeo (Editorial on shenanigans and costly trivial pursuits)

IBM Business Up, Stock Down (Analysis of Big Blue's third quarter business results)

INDUSTRY TRENDS

Updated 1/20/11, 6:30PM HST, adds Apotheker Fills Our First Prescription...

Analysis of Hewlett Packard's Fourth Quarter Fiscal 2010 Results

"Stealth CEO" Sounds Bullish in His First Public Appearance

Apotheker Claims "World Record" in Travel as His New Company Reports Solid Fourth Quarter Revenue and Earnings; Earthquake Puts Exclamation Mark on Our Report

Oracle Awarded $1.3 by California Jury

HAIKU, Maui,

Nov 23 – You've got to hand it to Hewlett Packard. You'd think that

after all the distractions the company has suffered in the last three months

its business might be slipping? Well, think again. One way or

another, HP is managing to survive its sex-scandal marred former CEO (Mark

Hurd), its schizophrenic board, and the "Silicon

Valley Rodeo" (Oracle's Larry Ellison gunning for the new HP CEO, Leo Apotheker). Which says a lot

about

the momentum a $126 billion-computer giant had built up under Mark Hurd.

Ellison gunning for the new HP CEO, Leo Apotheker). Which says a lot

about

the momentum a $126 billion-computer giant had built up under Mark Hurd.

HP's 8% rise in

revenue and a 5% increase in net earnings in its final quarter of fiscal

2010, both exceeding Wall Street expectations, sent the stock up 2.2% in

regular trading today even though the Dow stumbled 1.3%, as did the shares

of most HP's main competitors, including Oracle (down 3%), Microsoft (down

2.4%) and IBM (down 1.5%).

Year-to-date,

however, HP is still way behind the Dow and IBM share performances (right).

Year-to-date,

however, HP is still way behind the Dow and IBM share performances (right).

For the full fiscal year 2010, HP revenues were up 10% (up 8% in constant currency), while it's non-GAAP profit surged 14%. Which means that the company added nearly one billion dollars of revenue every month.

"I have seen firsthand that we have talented people who are focused on delivering value for our customers," said Apotheker in a statement. "Our market opportunity is vast, and I am confident that we will extend our leadership into the future."

During the teleconference with analysts, HP's "stealth CEO" joked that he may have set a world record for travel the past few weeks as he jetted around the globe to familiarize himself with HP's sprawling business. Apotheker had been largely missing from the public eye since he joined the company, leading some people to speculate that he was trying to avoid involvement in a legal battle with Oracle (see Silicon Valley Rodeo", Nov 4).

Oracle Wins in Court

Oracle tried to serve Mr. Apotheker with a subpoena to appear in court, but the company’s lawyers said they were unable to find him. Apotheker told the analysts last night that he has spent the last three weeks visiting customers and employees in the United States, Europe and Asia, but that he was now in the company’s headquarters in Palo Alto, California.

"I have been from

California to Massachusetts and Germany to Singapore, with many stops in

between," he said.

But even without his testimony Oracle prevailed in its case against SAP. This afternoon, the court ordered the German company, once let by Apotheker, to pay $1.3 billion to its California-base software competitor (Oracle wins $1.3 billion verdict in SAP trial, Nov 23). Oracle had been seeking $2 billion in damages.

In a thinly veiled reference to Oracle, Apotheker told the analysts on Monday night that his new company had managed to stay focused on its business through a challenging quarter. "A competitor has tried to distract us — and you — from the good work being done across HP’s business."

Reversing Hurd, Raising Salaries, Morale

Apotheker also announced that the company was reversing pay cuts for a majority of the employees affected by a February 2009 salary-reduction plan under former CEO Mark Hurd. HP reinstated a company 401(k) plan matching contributions as a fixed benefit, and instituted a new share-ownership plan that would allow employees to buy company shares at a 5% discount.

"HP employees are a highly competitive group who want to win," Apotheker said on a call with analysts. "They also want to be rewarded for their performance. ... I believe in the performance-driven culture, and our employees have been performing."

The moves appear aimed at lifting the morale of a company that’s been reeling from yet another turbulent leadership transition, and helping Apotheker feel more welcome at the iconic Silicon Valley company once admired for its employee-friendly culture.

But the move also reflects stiffening competition for talent in Silicon Valley and the broader tech industry — highlighted by Google Inc.’s recent decision to raise salaries by 10%.

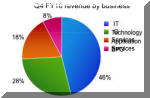

Business Segment Analysis

Geographies.

The Americas region shone the brightest in the fourth quarter.

Revenue was up 10% to $15.1 billion. Business in Europe was up 6% to

$12. 4

billion, and up 8% in Asia/Pacific to $5.8 billion. When adjusted for

currency, revenue was up 9% in the Americas, up 11% in Europe, the Middle

East and Africa and up 3% in Asia Pacific.

4

billion, and up 8% in Asia/Pacific to $5.8 billion. When adjusted for

currency, revenue was up 9% in the Americas, up 11% in Europe, the Middle

East and Africa and up 3% in Asia Pacific.

Revenue from outside of the United States in the fourth quarter accounted for 64% of total HP revenue, with revenue in the BRIC countries (Brazil, Russia, India and China) increasing 12% while accounting for 10% of total HP revenue.

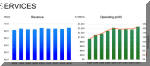

Services.

Services revenue was virtually

flat at about $9 billion in the fourth quarter. Revenue in each of

Infrastructure Technology Outsourcing, Application Services and Techno logy

Services grew roughly 1%. Business Process Outsourcing revenue was

down 11%.

logy

Services grew roughly 1%. Business Process Outsourcing revenue was

down 11%.

Operating profit was $1.5 billion, or 16.7% of revenue, up from $1.4 billion, or 16.2% of revenue, in the prior-year period.

So the slow growth which has plagued the performance of EDS while it was an independent company has now infected HP Services as well. No surprise there (see "Drumbeat Continues: Massive HP Layoffs Follow EDS Acquisition," Sep 2008). At the time, HP's CFO, Cathie Lesjak, said she expected the growth of the merged services unit to be 4% to 6%, down from 8% to 11% growth before EDS.

We were skeptical. "We felt what EDS needed back then is SALES growth, not cost cutbacks. It still does," we wrote in the above Sep 2008 Annex Bulletin.

Well, as you can see, with revenues being virtually flat in the fourth quarter, HP Services disappointed even relative to its disappointing outlook from 26 months ago.

Answering a tepid question about a services growth from an

analyst during the teleconference, Ann Livermore (right), who heads up both

Services and Enterprise Stor age

and Servers at HP, gave a long-winded answer that failed to hit the nail on

the head:

age

and Servers at HP, gave a long-winded answer that failed to hit the nail on

the head:

"You should think of our services growth as primarily organic growth," she said. "And as you've heard us say over the last few quarters, we've been very pleased with the signings."

Well, in HP's case the new business signings are a cat in the bag. The company doesn't release them, unlike some of its other major competitors, like IBM or Accenture. Or as EDS used to, but no longer does. So self-congratulatory comments such as the above are meaningless.

"We also feel very good about the quality of the pipeline, as well as the size of the pipeline, when we look at the deals that are in the funnel," Livermore added.

Ditto

re. the pipeline. HP doesn't publish its size. So unless we, the

outsiders, also get to take a look at the pipeline, HP executives opinions

about it could be like smoking a pipe. It feels good if you don't

inhale.

Ditto

re. the pipeline. HP doesn't publish its size. So unless we, the

outsiders, also get to take a look at the pipeline, HP executives opinions

about it could be like smoking a pipe. It feels good if you don't

inhale.

The final tip-off when something doesn't sell is to look for company executives to point out how supposedly the failing product generates a lot of drag-along business. It's called rationalization by diversion. Back to Livermore for some of that...

"We've seen our product pull-through increase 50% year-over-year. And that includes pulling through servers, storage, networking, software, printers and PCs. And since we closed the acquisition of EDS, as new deals are 'solutioned,' we have a higher percentage of the content that is 'solutioned' with HP. So that's not specifically services growth, but it's another valuable aspect of services helping our overall portfolio growth."

Compare the above HP executive's comment with the statement Sam Palmisano, the Big Blue chairman and CEO, made at the depth of the Big Blue stock blues (see IBM vs. HP: A Tale of Two Blues [Annex clients click here]. The IBM shares traded in the low 70s at the time.

What Palmisano said - "we will not rationalize cases for synergy" - stands out in stark contrast to what Livermore's reply to the analysts on Monday night. The IBM stock has roughly doubled in value since that statement was mode, and has significantly outperformed HP this year. Rather than "rationalize cases for synergy," IBM created synergies. And then let the numbers speak for themselves.

HP would be well advised to do the same, and publish its new contract signings and pipeline numbers. Then they could also speak for themselves.

Enterprise Storage and Servers.

We are sure that Livermore would have been much happier to talk about

the ESS unit which she also manages. For that was the best performer among the HP product lines in the fourth quarter. ESS revenu

among the HP product lines in the fourth quarter. ESS revenu e

was $5.3 billion, up 25%, with all of its three major segment growing in

double figures. ESS blade revenue was up 51%.

e

was $5.3 billion, up 25%, with all of its three major segment growing in

double figures. ESS blade revenue was up 51%.

Operating profit was also up - $730 million, or 13.9% of revenue, as compared to $481 million, or 11.4% of revenue, in the prior-year period.

Personal Systems Group. PSG has been another strong HP performer this year. But its growth slowed in the latest quarter. PSG revenue increased 4% to $10.3 billion, while PC worldwide unit shipments rose only 2% increase.

Notebook revenue for the quarter was down 3% from the prior year period, while Desktop revenue increased 13%. Commercial clients' revenue was up 20%, while Consumer revenue declined 10%.

Operating profit improved to $568 million, or 5.5% of revenue, up from $460 million, or 4.7% of revenue, in the prior-year period.

Imaging and Printing Group. Finally, HP's bread and butter in terms of profit, the IPG unit's revenue increased 8% to $7.0 billion in the fourth quarter. Printer unit shipments increased 14%, while supplies revenue was up 6%.

Commercial hardware revenue and Consumer hardware revenue rose 22% and down 2%, respectively. Commercial printer hardware units were up 43% and Consumer printer hardware increased 7%.

Operating profit was $1.2 billion, or 17.4% of revenue, versus $1.2 billion, or 18.1% of revenue, in the prior-year period. So even if the IPG operating margin has declined slightly since a year ago, it is still the best among the HP product lines.

HP Raises Outlook

Another reason HP shares rose today while the market generally sagged is that the company also raised its outlook for the first quarter and next year. HP said it now expected revenue of about $32.8 billion to $33.0 billion in the first quarter, GAAP diluted EPS in the range of $1.06 to $1.08, and non-GAAP diluted EPS in the range of $1.28 to $1.30.

HP expects full year fiscal 2011 revenue in the range $132 billion to $133.5 billion, GAAP diluted EPS in the range of $4.42 to $4.52, and non-GAAP diluted EPS in the range of $5.16 to $5.26. GAAP and non-GAAP diluted EPS includes a one-time gain of approximately $0.04 per share primarily related to the disposition of real estate.

"We are winning in the market, and we have a significant opportunity in front of us," Apotheker summed up his remarks. "We had a very strong Q4, and I am confident that we'll execute in Q1, and the years ahead."

Well, the new HP CEO certainly sounded bullish. It remains to be seen if the deeds will be as bullish as his words.

Bob Djurdjevic

P.S. Just as we were putting the

finishing touches on this report, this writer's desk, computer screen and

office started to shake. It was an earthquake (see "Ea rthquake

Shakes Maui", Nov 23, 6:34PM).

rthquake

Shakes Maui", Nov 23, 6:34PM).

"Was it something I said?" I joked. "Maybe that bit about Ann Livermore. Perhaps she is in cahoots with Goddess Pele and getting back at me for rattling her cage re. the services?" :-)

It was no biggie, though. Just like the HPS fourth quarter. Only 4.7 on Richter scale. Enough to rattle the windows and dishes but did not cause any damage or alarm. So onward and upward...

HAIKU, Maui, Nov 24 - Here’s a quick market update for you…

Ah, the day after…. HP stock sags (-1%), as IBM, Dow rise (+2.2%). Looks like the market is having some second thoughts about just how great things really are at the largest computer company in the world. Take a look...

Or is just the usual Wall Street "buy on rumor, sell on fact"-syndrome?

Happy Thanksgiving!

Apotheker Fills Our First Prescription, Reforms HP Board

HAIKU, Maui, Jan 20, 2011 - HP CEO Leo Apotheker partially filled our first prescription, reforming the schizophrenic Hewlett-Packard board of directors. Four of HP directors were shown the door today, while five new ones were ushered into the boardroom.

Back in August, when the HP executive crisis news first broke, we said that Maybe Entire HP Board Should Resign? Here's an excerpt...

Perhaps it is time for all HP Board members to acknowledge their lapses in judgment and resign collectively. For, they have failed to protect the HP shareholders' best interests. Which is their fiduciary duty one and the only raison d'etre (reason for being).

(An excerpt from HP's Hurd: Do As I Say Not As I Do - HP's "Humpty-Dumpty" who could "Walk on Water" could not walk his talk, Aug 7, 2010)

While Apotheker didn't change the entire board at once, he did a fair bit of house cleaning. Some of Mark Hurd's staunchest supporters on the board, including John Joyce, former IBM CFO from Lou Gerstner's era at the helm of Big Blue, are now gone. Two of the four departing directors -- Joyce and Joel Hyatt -- were named to the HP board during Hurd’s term as CEO. The other two ousted directors were Robert Ryan and Lucille Salhany.

You can read more about the HP board games in this Dow Jones MarketWatch story (HP Board Shake-up, Jan 21).

Our bottom line? This is good news for HP. An old Eastern European proverb says that "fish always stinks from the head." So do the corporate boards. And HP's has been dysfunctional long before Apotheker ever showed up on the scene. So starting to clean house in the executive suite - in contrast to Mark Hurd who laid off tens of thousands of employees - should help the new HP CEO win more badly needed employee support.

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXVI, Annex Bulletin 2010-17 Bob Djurdjevic, Editor

(c) Copyright 2010 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2010 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe