Annex Bulletin 2010-18 December 24, 2010

A partially OPEN edition

Silicon Valley Rodeo (Editorial on shenanigans and costly trivial pursuits)

IBM Business Up, Stock Down (Analysis of Big Blue's third quarter business results)

INDUSTRY TRENDS

Updated 12/24/10, 8:30AM HST, adds Market Update...

Analysis of BARRON's article on IBM

IBM Shareholders Should Enjoy New Year

Major Wall Street media gives thumbs-up sign for Big Blue

HAIKU, Maui, Dec 24 – In a Dec 24 note to clients, we said, "thought you might find the enclosed clip from a BARRON’S article on IBM interesting. It was published this morning, on Christmas Eve. Unfortunately for IBM, the markets are closed today"

IBM Shareholders Should Enjoy New Year (Dec 24)Barron's

- 5 hours agoThe technology giant's stock took more than a decade to revisit its 1999 high. The outlook should only improve from here. …

International Business Machines (ticker: IBM) a slow-growth company ("Smart Play," Dec. 28, 2009). We wrote that higher-margin products and services, productivity increases, stock buybacks, and continued expansion into fast-growing markets like the emerging world and corporate clouds would re-stoke growth. In the past 10 years, IBM had already dumped most of its money-losing hardware division and overhauled its pension plan.In November, shares of International Business Machines finally eclipsed their previous high—set in July of 1999—by hitting $147.53. The stock has since fallen back a bit, but a new high surely isn't another decade away; more like days or weeks. A year ago, we argued in Barron's that investors were wrong in deeming

[snip]

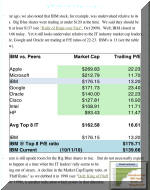

IBM watcher Bob Djurdjevic of Annex Research thinks IBM is still undervalued, noting it trades at discounts to Apple,

Google (GOOG) and Oracle (ORCL). In fact, using a price/earnings ratio of 16.6—the average multiple for the eight largest IT companies by market value—he thinks IBM is worth $176, or more than 20% above last week's level.--Leslie P. Norton [BARRON’s]

For more details re. the above quote, check out our analysis of the Top 20 companies stocks was done after the end of the third quarter (see Analysis of Top IT Cos' stock market & business performances, Oct 11). Here’s an excerpt which pertains to the IBM stock still being undervalued (it was $139 at the time, as you can see). As you can see, the fair value would be around $176.

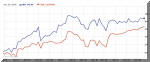

Also note, however, that I cautioned at the time NOT to necessarily expect the IBM stock to rise immediately to the $176 level, even if that would be a fair price relative to its peers. The stock market doesn’t care about being fair. As I said back in Oct, since the IT rally seemed to be running out of steam, it seemed unlikely that IBM would be an exception.

Here is what has actually happened since. After rising in October, IBM stock has been basically flat-lining since. Which is actually not bad, relative to the market. IBM has actually done better than the Dow of which it is a part.

Too bad for IBM the market is closed today. Big Blue shares might have gone up as a result. We’ll see what happens next week. The traders tend to have short memories.

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXVI, Annex Bulletin 2010-18 Bob Djurdjevic, Editor

(c) Copyright 2010 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2010 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe