Annex Bulletin 2009-09 May 5, 2009

A partially OPEN edition

Back on Growth Track - Analysis of IBM Global Services 2008 results

Sometimes Less Is More and Down Is Up - Analysis of IBM's 1Q business results

IT SERVICES

Updated 5/05/09, 9:30PM PDT

Analysis of Capgemini's 2008 and 1Q09 Business Results

Steady As She Goes

Paris-based Capgemini Is Another Global IT Services Company Weathering Economic Storm Reasonably Well

HAIKU, Maui, May 5 –

"Steady as she goes," an old

seafarers' adage, would be a good way to describe the Capgemini's recent

voyage through the stormy global economic seas. In 2008, the

largest European IT services company reported flat revenues of

€8.7 billion in Euros

despite having to face headwinds most of the year. But the rise of the

dollar against the Euro last year took the m

down 13% to $11.1 billion in U.S. currency.

m

down 13% to $11.1 billion in U.S. currency.

In the latest quarter, Capgemini actually reported a 1% revenue increase in Euros to €2.2 billion. New contract sales also rose slightly, with outsourcing doing well (up 40%), while consulting and systems integration declining 9%.

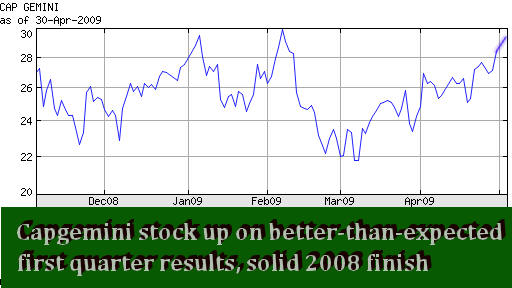

The better-than-expected results boosted the Capgemini stock, which closed at €29.11 today, close to the highest levels it has attained in the last six months. As a result, Capgemini, whose shares trade on the Paris Bourse, has outperformed both the Dow and the S&P indexes during the same time frame.

Business Segment & Profitability Analysis

What also buoyed investors in the last six months was that Capgemini has

found ways to actually improve its profitability during a period of slow or

no growth (left chart).

Operating margin – which was up in all four horizontal activities (right) – was €744 million in 2008, or 8.5% of revenues. That's up over a point from 7.4% the year before. Net profit for the year, after some restructuring charges, amounted to €451 million, or 5.2% of revenues, up from 2.5% in 2007.

In ter ms

of geographies, the Benelux countries reported the best performance in 2008,

with about a 12% growth. Revenues in the rest of Europe and Latin

America were also strong, rising about 8% last year. France and North

America were also up, 5% and 3% respectively (the latter in terms of organic

growth, i.e., adjusted for currency translations). But Capgemini's

biggest geographic region - U.S. and Ireland - was down 14% as reported, and

0.5% organically.

ms

of geographies, the Benelux countries reported the best performance in 2008,

with about a 12% growth. Revenues in the rest of Europe and Latin

America were also strong, rising about 8% last year. France and North

America were also up, 5% and 3% respectively (the latter in terms of organic

growth, i.e., adjusted for currency translations). But Capgemini's

biggest geographic region - U.S. and Ireland - was down 14% as reported, and

0.5% organically.

Overall, the company reported a 5% organic growth in 2008, despite varying rates of change across the world.

In the latest quarter, Italy and the U.K. recorded highest rates of growth

on an organic basis (up 8% and 7% respectively), while North America's

revenues declined 7%, measu red

the same way.

red

the same way.

Manufacturing and distribution continues to be Capgemini's biggest industry segment, accounting for about 28% if total revenues. It is follows by the public sector, which represents about 26% of the total. Financial services and utilities are next with 17% and 12% revenue shares. Despite the media headlines which highlighted the banking sector woes, there has not been any major changes in Capgemini's industry alignment since 2007.

Summary & Outlook

As you can see from the preceding, Capgemini has managed to sail through turbulent waters in the last two years with minimal damage to its business. In fact, its "steady as she goes" strategy, which included increasing offshoring of its services deliverables, has served it well. As a result, the company's bottom line profitability has grown a little faster than its top line revenues.

The company management have been reluctant to forecast the full year's results for 2009, citing unstable global economic conditions as the reason. But they have guided the analysts who follow the company toward a slight revenue decline in the first half of the year. It remains to be seem whether or not the steps Capgemini has taken to reallocate its costs to lower labor markets will be sufficient to sustain its profit margins at a time when revenues are under pressure.

|

Annex Clients: CLICK HERE for detailed Capgemini 2008 P&L tables & charts |

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

![]()

For additional Annex Research reports, check out... Annex Bulletin Index (including all prior years' indexes)

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXIII, Annex Bulletin 2009-09 Bob Djurdjevic, Editor 894 E Kuiaha Rd, Haiku, HI 96708; Tel/Fax: +1-602-824-8111

(c) Copyright 2009 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2009 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

![]()

IBM's Holistic Approach - Treating businesses like living organisms - secret of success

IBM Tries to Pull Dow, HP Up - Big Blue stock up sharply after CFO remarks at investor conf

Hurd's First Stumble - HP's 1Q09 revenues, earnings disappoint Wall Street

Two Thumbs Up for Big Blue - Analysis of IBM 4Q08 business results

Big Blue: All Heart - IBM creating new jobs in American Heartland

When You Catch a Tiger by the Tail... - An editorial about greed & success

Squeezing the Consumer Dry (Greed fueled both bankers & oilmen's try to squeeze blood out of stone - consumer)

The Year of Living Dangerously - Analysis of global investment trends