Confidential

Client Edition

IBM CORPORATE / INDUSTRY TRENDS

Updated 2/25/05, 2:05PM MST (adds "IBM gains market share")

Annex Research’ IBM Business Segment Forecast 2005-2006

Servers to Grow Again

Linux, Recentralization and SMB Reintegration Trends – Main Demand Drivers

PHOENIX,

Feb 22 – Who would

have thought that a cute little penguin could end up doing what

multi-billion software giants have failed to – shake, rattle or break

some Windows; cause a Solar(is) eclipse or two; and stir up the pot in the

PC server business. In short,

Linux is creating new tectonic movements in the IT industry. A

fringe is becoming mainstream.

PHOENIX,

Feb 22 – Who would

have thought that a cute little penguin could end up doing what

multi-billion software giants have failed to – shake, rattle or break

some Windows; cause a Solar(is) eclipse or two; and stir up the pot in the

PC server business. In short,

Linux is creating new tectonic movements in the IT industry. A

fringe is becoming mainstream.

That’s

been the trend with Linux ever since it acquired a (Big Blue) “sugar

Daddy.” Together with

Novell and Red Hat, among some ISVs (Independent

Software Vendors), IBM

is using it to help generate new demand for its servers.

Its last week’s “Chiphopper” announcement is the latest (big)

step in that direction.

“This

is an industry first,” said

IBM's Scott Handy, vice president of Linux systems.

“No one has ever done cross platform for an operating systems

because we’ve never had a cross platform for an operating system

before.”

Chiphopper (named for its capability allowing ISV

applications to easily move, or "hop," across various chips) is

a no-charge IBM offering that empowers ISVs to take their existing x86

Linux applications, and easily test, port, and support those applications

across all IBM systems including the iSeries, pSeries, zSeries, xSeries,

BladeCenter, TotalStorage and the OpenPower line of Linux-based IBM

servers.

“Multi-platform Linux is already a reality with our customers and our ISVs, and the introduction of Chiphopper will accelerate that process,” Handy added. “Linux on x86 (Intel and MD chips) is already huge, and Chiphopper will not only increase that market opportunity, but also expand it to additional platforms faster than what was possible.”

Chiphopper promises to rearrange the order of things in the IT server world. It will siphon off the opportunities from IBM rivals, and direct them into the Big Blue server pool.

“This differentiates us from Dell and HP,” Handy continued. “They are both focused just on x86. We’re focused on something much bigger. We’ve always thought that Linux is bigger than just an OS – (ours is) a multi-platform approach to Linux. We announced that when we announced the eServer lines.”

IBM’s objective? Take the 6,000 or so Linux x86 applications and move more of them to other IBM platforms.

“We’re doing quite well already,” Handy said. “We have 600 of them on the mainframe; Power (technology) has thousands of them. But we think we’ll get additional ISVs to come to our platform” because of this new feature (Chiphopper).

As a result, IBM expects to double the number of Linux applications (to 12,000) by the end of 2007. Nor is that just some “blue sky” talk. Over 2,500 new Linux applications were added to the IBM pool in 2004.

IBM

Linux Already Gaining Market Share

Meanwhile,

the Linux-driven server revenue gro wth

continues to outpace that of the rest of the IT industry.

And IBM servers are the key beneficiaries.

IBM is already taking market share away from the giant Microsoft

and some IBM competitors in the server business.

wth

continues to outpace that of the rest of the IT industry.

And IBM servers are the key beneficiaries.

IBM is already taking market share away from the giant Microsoft

and some IBM competitors in the server business.

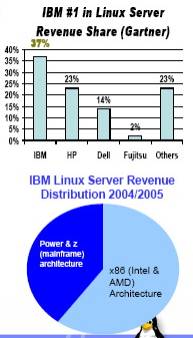

Big Blue now commands a 37% share of Linux server revenues, equaling the combined total of the next two largest competitors – HP and Dell (see the chart).

The third quarter Linux server revenues have jumped by 56% to $1.3 billion, growing four times faster that the Windows’ 13% increase, and nine times faster than the total server market (+6%), according to Gartner Group. It was the fourth quarter in row that Linux had mustered revenues of over a billion dollars.

Evidently,

the “little penguin” is all grown up now.

And the iSeries, IBM’s “problem child” of 2004, is one of the

platforms on which it is happily dancing.

Small and large customers are now embracing Linux, as are little

and big ISVs.

Evidently,

the “little penguin” is all grown up now.

And the iSeries, IBM’s “problem child” of 2004, is one of the

platforms on which it is happily dancing.

Small and large customers are now embracing Linux, as are little

and big ISVs.

SAP, for example, a $10 billion-German software giant, has over 2,800 installations of its popular enterprise software on Linux. SAP and IBM had a “huge win” (worth over $20 million) in the third quarter in Spain with Linux on Power (on zOS), according to Handy.

“This (collaboration between SAP and IBM) is an example of how we are automating it (Linux) for the masses,” he said.

Novell and Red Hat, for example, are two of 20 prominent ISVs who have also worked with IBM on the Chiphopper pilot’s design and launch.

“Novell

is very focused on reducing barriers to adoption of Linux in the

enterprise,” said Hal

Bennett, Novell’s vice president of business development.

“This is great news for customers who want to leverage the power

of Linux.”

“Global Linux adoption into the

enterprise, government and mainstream is accelerating,” noted Ed

Boyajian, vice president of worldwide alliances at Red Hat.

“The Chiphopper program will offer further support to developers and

ISVs working to certify applications on Linux."

Rattling

the Competition

Translating the software-speak into plain English, the Chiphopper may cause a (Sun Microsystems’) Solar(is) eclipse; rattle, shake or break some Windows, and in general stir up trouble among the IT server providers.

Sun Microsystems, Fujitsu, Dell and HP, for example, will have to figure out how to prevent IBM from using the Chiphopper to drain and siphoning off their opportunities. For, IBM has its big marketing guns aimed straight at them.

Along

with the Chiphopper, IBM announced three special marketing programs that

target specifically customer migrations from Solaris to Linux, from

Windows to Linux, and from x86 Linux to IBM’s multi-platform Linux (see

the chart).

And

the company is putting its money where its mouth is.

Big money. IBM will

reportedly spend $100 million during the next three years promoting the

Linux adoption across its platforms, according to a Newsfactor

report.

Empire

(Microsoft) Strikes Back

No

wonder Microsoft is taking the Linux threat seriously.

In response, it is using typical marketing tactics of an incumbent.

When IBM mainframes were dominating the world of computing, we used

to call it FUD (spreading Fear, Uncertainty, Doubt).

If you click on the banner displayed at the Microsoft web

site (below right), you’ll be able to see its “Get the Facts on Windows and

Linux”-page. The page reads

like that old library book - “An unbiased history of the American Civil

war from a southern point of view.”

right), you’ll be able to see its “Get the Facts on Windows and

Linux”-page. The page reads

like that old library book - “An unbiased history of the American Civil

war from a southern point of view.”

Bias

is okay in marketing. But by

invoking “total cost of ownership” as its alleged advantage, Microsoft

is inviting trouble. Because

customers from three continents, with whom we spoke in the last several

months of doing research in the server market, have told us that the high

cost of Windows-Intel servers has been the main reason for their “server

consolidation” projects. And

the higher reliability of IBM servers has been the reason they

consolidated around IBM, not Microsoft.

“For

the full year (2004), the SMB (small and medium size business) grew at a

lower rate than IBM as a whole (8% vs. 9%), giving rise to questions if

Big Blue’s SMB campaign may be running out of steam,” we wrote

in January. In other

words, 2004 was a year of tepid increase for what is supposed to be

IBM’s fastest growing market (see “Finally

Heard!”, Jan 2003).

Well, IBM seems bent on changing that again.

The “SMB Express” series of announcements, also made last week,

are focusing the company once again on this $13 billion market segment

crucial for its future growth. More

importantly, Big Blue is playing right into a global trend that we first

identified just over a year ago in our latest “Holy Grail” search (see

“IT

Industry: Whither Goeth It?”, Jan 2004).

series of announcements, also made last week,

are focusing the company once again on this $13 billion market segment

crucial for its future growth. More

importantly, Big Blue is playing right into a global trend that we first

identified just over a year ago in our latest “Holy Grail” search (see

“IT

Industry: Whither Goeth It?”, Jan 2004).

How? Well,

we said last year:

Big Blue is actually a wonderful starting point in a quest for a new Holy Grail. For, it is both a provider and a consumer of change. So if one can figure out where IBM’s new Holy Grail is, the same “secret recipe” for growth and success should work for other corporate giants.

(Excerpt from “IT Industry: Whither Goeth It?”, Jan 2004)

And what was the “secret recipe” that we

gave IBM and other IT vendors?

If the

end result is to be a “dynamically changing, constantly evolving”

enterprise, it will take both technology (to create tools) creative minds

(to use them).

The successful process, as we see it, is analogous to creating a painting or a sculpture. The IT services vendor brings to the table his toolkit and paints. The toolkit consists of various building blocks, along with instructions on how to use them…

Together with the client, he designs a kaleidoscope of shapes that the client CEO wants his “adaptive enterprise” to take… The “Chief Creative Officer” is the virtual mother in procreation of the “adaptive enterprise,” partnering with the corresponding number at the IT services company (the virtual father).

(Excerpt

from “IT

Industry: Whither Goeth It?”, Jan 2004)

And now, keeping in mind our year-old

theoretical image of “adaptive enterprise” creations, let’s contrast

IBM’s latest announcements. Keep

in mind that the SMB Express is a toolkit intended to enable the IBM

Business Partners to act as “change agents” in helping their

customers create

“adaptive enterprises.”

“In the design of a solution… what we’ve

done is to give the partner fairly quickly and a low risk

capability to design a solution for a particular target industry,

and customer in that industry,” explained Chris Wicher, vice

president of development in the IBM software group. “(The solution) is based on tried and true repeatable

architectures for that exact kind of solution and for other mid-market

customers. The partner then

can rapidly customize to the end user’s domain.”

It other words, the SMB Express is a “teach

the teachers” toolkit based built on open systems solutions.

IBM teaches its partners how to make their customers more efficient

and adaptable.

What’s in it for IBM? Well, first the product revenue. But also some services income. Vickie Hessenius, an SMB portfolio manager in the IBM software group, said that the services/product revenue ratio for a typical SMB engagement is “1.5 to 2 times.” In other words, up to two-thirds is the services’ content. And the partner and IBM share it.

So it’s a win-win deal. “One partner has said that their development time has been shortened by 40%,” Hessenius added.

The

IBM SMB Express helps the partner develop quickly a solution that moves

more IBM product at a relatively low marketing cost.

IBM Global Financing also pitches in with a virtually instant

credit approval, something that’s sometimes a problem in the SMB market.

And both IT providers share in the services revenue that results

from deployment of an IBM product.

“Once a solution is deployed, (SMB) customers, who don’t have IT specialists, look at their IT provider as for support a ‘jack of all trades’,” Wicher said. “So IBM has given its Business Partners a single integrated Admin. Console through which they can support the customer” - without ever going to their physical location.

All

IBM Power- and Intel-based servers, as well as IBM (now Lenovo) PCs, will

get a boost from this program (see the chart).

Recentralization and Reintegration Trends

IBM servers are also getting a shot in the arm

from two customer-driven trends. One

is recentralization. Another

is reintegration. The

zSeries is the main beneficiary of the former trend.

The iSeries will profit from the latter.

What are these two trends about?

Large customers are increasingly going through

“server consolidations” projects in an effort to lower their cost of

ownership while increasing the global reach (see Fidelilty, for example,

in “IBM

Server Renaissance”, Nov 2004).

The final result is a recentralization of IT resources.

Since the zSeries offers a unique single image view of the world,

it is a natural winner in situations like that.

consolidations” projects in an effort to lower their cost of

ownership while increasing the global reach (see Fidelilty, for example,

in “IBM

Server Renaissance”, Nov 2004).

The final result is a recentralization of IT resources.

Since the zSeries offers a unique single image view of the world,

it is a natural winner in situations like that.

Midsize customers are also going through

“server consolidations” for much the same reasons. Since the iSeries, thanks to its integrated nature, offers by

far the lowest cost of ownership, especially compared to the popular

Windows/Intel-based servers, it stands the reap the benefit the most from

this reintegration trend. By

contrast, the Unix-based servers (pSeries in IBM’s case) are being

squeezed both from the top and from the bottom of the server stack.

The

Windows/Intel-based servers (xSeries in IBM’s case), are basically

rising on the coat tails of Microsoft’s marketing power.

In most organizations they tend to “just happen” because some

user somewhere in the company found a solution he/she liked.

They will keep on growing until such time that the CEO or CFO of

such a user company puts his/her foot down, and demands that the IT

function reign in the runaway server costs.

Enter recentralization and reintegration

trends.

IBM Revenue Forecast

Servers. Now, let us try to reduce all these new trends to an IBM revenue forecast. We expect the IBM overall server revenues to continue to grow in the 2005-2006 time frame, at about 4% and 5% respectively to $16.3 billion.

Within that, however, the pSeries revenues is

likely to decline, while the storage business will be basically flat.

The zSeries, iSeries and zSeries revenues, however, will all

increase at varying rates this year and next (see the chart).

PCs & Technology. We made an assumption in our revenue forecast that the IBM PC/Lenovo deal would close in the second quarter, as planned. Therefore, we only included one quarter’s worth of PC revenue in our estimates.

As a result, despite the expected increases

in PC and printer revenues from continuing operations, the overall IBM PC

revenues will drop by 55% and 43% to $5.7 billion and $3.3 billion

respectively in 2005 and 2006.

As for IBM Technology revenues, they have

always been the tail end of the whip of the computer industry demand

curves. So we basically

expect this business to tread water in 2005-2006, as IBM maybe looks to

unload it to some other industry player with lower margins.

Software. IBM Software revenue will continue to grow in the next two

years at an aggregate rate of 6% and 7% respectively. Within those composite rates, however, there is quite a

mish-mash of expected growth/decline changes for its various business

segments (see the chart).

Software. IBM Software revenue will continue to grow in the next two

years at an aggregate rate of 6% and 7% respectively. Within those composite rates, however, there is quite a

mish-mash of expected growth/decline changes for its various business

segments (see the chart).

IBM Global Services. After years of being the fastest growing segment of Big

Blue’s business, IGS is likely to become a drag on IBM’s growth this

year and next. Unless, of

course, John Joyce, IGS’s head, does

something rather

dramatic to turn things around.

The reason for our relative pessimism were the

disappointing IGS new contract sales and “rescoping” results in 2004.

One curtailed the fresh new blood supply; the other drained it in

enormous amounts. And in an

annuity-type business, such shortfall leaves deep and long-lasting scars

on its financial results and prospects for growth.

What sort of dramatic steps can Joyce take? Well, he must either sharply curb its “rescoping” losses, or significantly increase its new contract sales. Or both. Or IGS must seek to acquire companies that can bolster its growth (see “Save, Split and Spend,” Apr 2005).

Since there is no

evidence that either of the three IGS boosters are in progress, we are

expecting its revenues to grow at 3% both this year and next. This would put it at just shy of the $50 billion mark by the

end of 2006.

Of course, should IGS take our advice and

implement one or all three steps we recommended, its growth rates will be

higher than those outlined in this forecast.

And so will IBM’s.

Overall IBM. Speaking of which, we expect IBM global revenues to decline

to $91.7 billion in 2005, before rising to $92.8 billion in 2006.

With PC Lenovo business added to it, that would be $100 billion and

$105 billion for the next two years, or 4% and 5% increases respectively.

Not much to write home about, but it will be a more profitable growth than it has been in the past (stand by for our annual IBM five-year forecast next month which includes the full P&L). And that’s goodness for IBM shareholders. Quality seems to be finally winning over quantity at IBM.

PHOENIX, Feb 25 - As expected, IBM servers continued to gain market share in the fourth quarter of 2004, according to the just-released data by IDC. IBM extended its lead with 38% market share of revenue, up 6.5% year over year.

For the full year 2004, IBM's share of global server revenues was up by 1.2%. The only other vendor to have gained share in 2004 was Dell, with a 0.4% increase. Sun Microsystems was the biggest loser with a 1.1% decline in its market share.

For the full year, IBM's share of the global server market was 33%, followed by HP's 27% and Sun's 11%, according to IDC.

Linux and Windows servers showed the fastest growth last year, increasing by 36% and 16% respectively. HP led the Linux market with a 26% market share, followed by IBM (24%) and Dell (26%).

PHOENIX,

Feb 25

- Big Blue's iSeries servers got another marketing boost today when IBM

announced that it would significantly increase its investments to engage

nearly 10 times as many partners developing software applications for the

iSeries platform (also see IBM SMB Express

above).

"We wanted to smash the barriers that stand in our partners' way and accelerate their ability to deliver critical innovation," said Mark Shearer, general manager, IBM iSeries, in a release. "By expanding our support from hundreds to thousands of iSeries partners, IBM expects to open up a floodgate of innovation from third-party software vendors and developers who are eager to create on demand applications for the rapidly growing small and medium business market."

As you saw in our earlier (Feb 22) report, we expected the iSeries revenues to grow this year and next. The ISV programs, such as the one announced today by IBM, are one reason why the iSeries recovery is likely to gather steam in 2005.

Happy

bargain hunting

Bob Djurdjevic

For additional Annex Research reports, check out... 2005

IT:

IBM

Servers to Grow Again (Feb 2005);

Carly's

Fickle Fans (Feb 2005); CSC:

Gearing Down on Purpose

(Feb 2005); EDS:

Grossly Overpriced Stock (Feb 2005); IBM

Historical Update: 2004 Shot in the Arm (Feb 2005);

New HeadTurners Series #1 (Feb

2005); IBM:

A Crescendo Finale! (Jan 2005); Accenture:

Strong Finish, Better Start (Jan 2005); Annex

Coverage 2004: IT Services Dominate (Jan 2005) Or just click on Volume XXI, Annex Bulletin 2005-05 Bob Djurdjevic, Editor 4440 E Camelback Rd #29, Phoenix, Arizona 85018 The copyright-protected information contained in the ANNEX BULLETINS

and ANNEX NEWSFLASHES is part of the Comprehensive Market Service (CMS). It is intended for the exclusive use

by those who have contracted for the entire CMS service. Home |

Headlines | Annex Bulletins

| Index 2005 | About

Founder | Search | Feedback

| Clips | Activism

| Client quotes | Workshop | Columns

| Subscribe ![]()

![]()

and use appropriate

keywords.

and use appropriate

keywords.

February 22, 2005

(c) Copyright 2005 by Annex Research, Inc. All rights reserved.

e-mail: annex@djurdjevic.com

TEL/FAX: (602) 824-8111