Annex Bulletin 2009-17 October 1, 2009

A partially OPEN edition

A Fading Star (Analysis of Accenture's 4Q09 business results)

Tempest in a Tea Pot (Analysis of latest IT services industry M&A's)

IT SERVICES

Updated 10/01/09, 7:40PM HIT

Analysis of Accenture's Fourth Quarter FY09 Business Results

A Fading Star

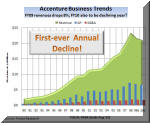

Erstwhile IT Services Highflyer Disappoints Again, Reports 3rd Down Quarter in a Row, 1st-ever Annual Revenue Drop; Profit Dips 41%

HAIKU, Maui,

Oct 1 – An erstwhile IT services highflyer is quickly becoming a fading

star. Accenture reported its fourth quarter fiscal 2009 results after

the markets closed today, and the picture wasn't pretty. It was a

third declining quarter in a row, with revenues dropping 14% and earnings

plummeting 41%, partly due to a $253 million restructuring charge. Perhaps

even more disturbing as a sign of things to come is that the new bookings

plummeted 2 8%,

led by a 34% decline in outsourcing signings.

8%,

led by a 34% decline in outsourcing signings.

Once upon a time, Accenture

executives enjoyed the luxury of letting their numbers do talking.

Today, all the spin talk and

fancy

executive footwork could not offset the obvious conclusion: IT services

industry's once brightest star is quickly becoming a fading star. The

fact that this quarter marked the end of the first declining year in the

company's history merely underscored this point.

fancy

executive footwork could not offset the obvious conclusion: IT services

industry's once brightest star is quickly becoming a fading star. The

fact that this quarter marked the end of the first declining year in the

company's history merely underscored this point.

"We went through the deer in the headlights phase, then the acceptance of the new normal phase, and now people are starting to look ahead," Bill Green, Accenture's CEO, told a post-release conference call. "Our theory, and our hope in all honesty is, we're going to cross the line into 2010. We're going to be in a different scenario ... people will move from the planning and design stages into implementation."

But the CFO, Pam Craig, cast a pall even on that outlook. She did not think we would see an improvement until the second half of next year.

"We expect the first half of fiscal 2010 to be challenging year-on-year,"

she told the analysts. "We are assuming that the global economy and our

business will improve in the second half of the fiscal year, even though it

is still an uncertain and unpredict able

time."

able

time."

Yet Accenture still evidently has some supporters on Wall Street. Its stock suffered only a modest decline in after-hours trading despite the disappointing results and gloomy forecasts. Its share slid 56 cents, or 1.5%, to $35.97 in after-hours trading, after falling 74 cents to close the regular session at $36.53. Perhaps a wider investor audience tomorrow morning will look at the latest results a little more soberly. Which is why the Accenture stock may be poised for a steeper decline in regular trading tomorrow.

What did not help Accenture's matters is that Green announced he would also delay a regularly scheduled session with analysts until 2010, i.e., until the first fiscal quarter results are in. To us that sounded like a stay of execution prayer; as if the CEO was hoping the marketplace would offer him a pardon before having to face the Wall Street firing squad.

Alas, based on the kinds of tepid questions we have heard them ask the HP and Accenture executives in the last two quarterly calls, Green's fears were probably unfounded. For, if Wall Street analysts were to shoot anything at all, they would be likely firing blanks.

Some Positive Moves

Meanwhile, evidently trying to blunt the sharpness of its business decline, Accenture made some positive moves that should encourage investors. The company said it would raise its cash dividend by 50% to 75 cents per share. Payments will be semiannual, instead of annual, starting in the third quarter of 2010, the company said. The board also authorized the repurchase of $4 billion-worth of its own shares.

And even though the fourth quarter charge negatively impacted the earnings, Wall Street is likely to look at it as a positive. For, the restructuring was related to "the realignment of the company's work force" and to global real estate consolidation, the company said in a release. In August, Accenture said it would cut 336 senior-level executive positions, totaling about 7% of its senior executives, and reduce office space.

Seeing so many executive heads roll is not a typical response in corporate America to one's economic problems. Which is why that particular move is likely to resonate well with investors and shareholders. It is an indication that the top Accenture executives are grabbing the bull by its horns rather than pussyfooting around it on the periphery, as most Fortune 500 companies seem to react to early stages of a decline.

Business Segment Analysis

As we p ointed

out earlier, revenues for the fourth quarter were down 14% as

reported,

ointed

out earlier, revenues for the fourth quarter were down 14% as

reported, and 7% in constant currency. Europe led the decline, and the U.S.

dropped in double digits as well. The only geographic region to have

experienced meager growth (1%) was Asia/Pacific, the smallest segment.

and 7% in constant currency. Europe led the decline, and the U.S.

dropped in double digits as well. The only geographic region to have

experienced meager growth (1%) was Asia/Pacific, the smallest segment.

In terms of horizontal activities...

Consulting net revenues were $2.91 billion, a decrease of 19% in U.S. dollars and 12% in local currency.

Outsourcing net revenues were $2.23 billion, a decrease of 7% in U.S. dollars and an increase of 1% in local currency.

But as we also noted earlier, the new bookings declines were reverse, with outsourcing dropping more than the consulting signings.

New bookings for the fourth quarter were $5.54 billion. This

reflects a negative 6% foreign-currency impact compared with the fourth quarter of fiscal 2008.

foreign-currency impact compared with the fourth quarter of fiscal 2008.

Consulting new bookings were $2.87 billion, or 52% of fourth-quarter total, down 21% from a year ago.

Outsourcing new bookings were $2.68 billion, or 48% of fourth-quarter bookings, down 34% from the fourth quarter of FY08.

Such deep double-digit declines in the latest quarter in BOTH of the company's two major horizontal activities have got to be worrisome in terms of the future revenue and profit outlook. Maybe that's why the Accenture CFO warmed the analysts not to look for any quick recoveries till the second half of fiscal 2010.

New bookings for the full fiscal 2009 reflect a negative 8% foreign-currency impact compared with fiscal 2008, Accenture said. As reported, however...

Consulting new bookings were $12.78 billion, a decrease of 14 % in U.S. dollars and 6% in local currency.

Outsourcing new bookings were $11.12 billion, a decrease of 7% in U.S. dollars and an increase of 1% in local currency.

When it comes to industry segment breakdowns, Accenture's fourth quarter report card is unusually full of red bars pointing downward. Only the public sector showed modest growth, both as reported and in constant currency. Alas, that's the company's smallest industry sector now.

- Communications & High Tech: Revenue of $1,118 million, compared with $1,411 million for the fourth quarter of fiscal 2008, a decrease of 21% in U.S. dollars and 15% in local currency. Consulting revenues

declined 26% in local currency and outsourcing revenues declined 2% in local currency.

Financial Services: Revenues of $1,017 million, compared with $1,249 million for the fourth quarter of fiscal 2008, a decrease of 19% in U.S. dollars and 10% in local currency. Consulting revenues declined 12% in local currency and outsourcing revenues declined 8% in local currency.

Products: Revenues of $1,286 million, compared with $1,546 m

illion for the year-ago period, a decrease of 17% in U.S. dollars and 10% in local currency. Consulting revenues declined 22% in local currency and outsourcing revenues increased 9% in local currency.

Public Service: Revenues of $776 million, compared with $731 million for the year-ago period, an increase of 6% in U.S. dollars and 12% in local currency. Consulting revenues increased 19% in local currency and outsourcing revenues increased 2% in local currency.

Resources: Revenues of $943 million, compared with $1,051 million for the same period of fiscal 2008, a decrease of 10% in U.S. dollars and 2% in local currency. Consulting revenues declined 5% in local currency and outsourcing revenues increased 5% in local currency.

Clearly, not all is gloom and doom in Accenture's report card. There are some bright spots besides the government business, such as increases in outsourcing revenues in Products and Resources. But they were evidently insufficient to offset the overwhelming weight of declines in the rest of the company's business units.

Summary & Outlook

CEO Green said that while he’s seeing signs clients are resuming spending, his forecast is conservative.

“We do not like to disappoint,” he said. “If you get out ahead of yourself, it doesn’t serve anybody well.”

Global technology spending will decline 8% this year, according to Goldman Sachs. But these figures may quickly change if the market momentum of positive psychology carries forward into the fourth calendar quarter, typically the biggest three-month period of the year for most companies with fiscal years ending Dec 31.

But with the Dow being down on the first day's trading of the fourth quarter by 203 points today, that's hardly a certainty. Perhaps that's why the Accenture executives were indeed cautious in their outlook.

They expect revenues for the first quarter of fiscal 2010 to be in the range of $5.3 billion to $5.5 billion, assuming a neutral foreign-exchange impact compared with the first quarter of fiscal 2009. For the full fiscal year 2010, Accenture expects revenue decline in the range of 3% in local currency to a growth of 1%.

The company forecasts diluted EPS for the full fiscal year to be in the range of $2.64 to $2.72, and the operating margin of 13.4%. That would be a substantial improvement over the 12.2% operating margin in the current fiscal year, obviously including the fourth quarter charge.

The company expects operating cash flow to be $2.4 billion to $2.6 billion; and free cash flow to be in the range of $2.1 billion to $2.3 billion. The annual effective tax rate is expected to be in the range of 30 percent to 32 percent, as compared to 27.6% in fiscal 2009 and 29.3% the year before.

Finally, Accenture is targeting new bookings for fiscal 2010 in the range of $23 billion to $26 billion. Which is a modest increase from the $23.9 billion of new business the company closed in the 2009 fiscal year.

|

Click here for detailed tables and charts (Annex clients only) |

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXIII, Annex Bulletin 2009-17 Bob Djurdjevic, Editor Tel/Fax: +1-602-824-8111

(c) Copyright 2009 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2009 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

![]()

Less Than Meets the Eye - Analysis of HP's 3QFY09 results

Big Blue Blows Lid Off Forecasts - Analysis of IBM's 2Q09 results

Apple, Google Lead Comeback - Analysis of Top IT Cos' stock & business performances

Revenues, Earnings Drop - Analysis of Accenture's 3QFY09 business results

IBM Wins the "Gold" - Analysis of IT Services Octathlon 2009 results

Suddenly, All Lines Point South - Analysis of HP's 2Q09 business results

Back on Growth Track - Analysis of IBM Global Services 2008 results

Sometimes Less Is More and Down Is Up - Analysis of IBM's 1Q business results

IBM's Holistic Approach - Treating businesses like living organisms - secret of success

IBM Tries to Pull Dow, HP Up - Big Blue stock up sharply after CFO remarks at investor conf

Hurd's First Stumble - HP's 1Q09 revenues, earnings disappoint Wall Street

Two Thumbs Up for Big Blue - Analysis of IBM 4Q08 business results

Big Blue: All Heart - IBM creating new jobs in American Heartland

When You Catch a Tiger by the Tail... - An editorial about greed & success

Squeezing the Consumer Dry (Greed fueled both bankers & oilmen's try to squeeze blood out of stone - consumer)

The Year of Living Dangerously - Analysis of global investment trends