Annex Bulletin 2012-04 March 15, 2012

A partially OPEN edition

Oracle Runs Out of Oracles (Analysis of latest quarterly results)

INDUSTRY TRENDS

Updated 3/15/12, 9:00AM HST

Apple Shares Go Through the Roof, Microsoft, IBM Follow, Too

Wall Street in Love

No Signs of Caution on Ides of March, IBM Forecast Overshadowed by Wall Street Action

HAIKU, Maui, Mar 15, 2012 - Wall Street is in love! That's the only explanation we can offer for the market's completely irrational behavior. Investors have cast caution aside even on the auspicious Ides of March.

"Beware of

I des

of March"-has been a time-tested warning offered to

the wise ever since Julius Caesar was stabbed 23 times on this day in 44 BC

at the Roman Forum (right). It is falling on deaf ears on Wall Street

these days.

des

of March"-has been a time-tested warning offered to

the wise ever since Julius Caesar was stabbed 23 times on this day in 44 BC

at the Roman Forum (right). It is falling on deaf ears on Wall Street

these days.

This week alone, Apple shares have risen nearly 12% - more than double the amount the whole market appreciated for an entire year (2011 - Dow was up 5%). For the first two-and-a-half months of 2012, Apple shares are up 45%, Microsoft's 27%, IBM's 10%... lifting the Dow to a level 8% higher than at the start of 2012.

That's sheer madness. Market values are rising based on FUTURE expectations not real earnings. The P/E ratios prove it. Apple's is 16.7, IBM's is 15.8, Microsoft's is 11.9, Intel's 11.60... while HP's and Dell's are 8.5 and 9.2 respectively.

Analysts' gullibility or obsequiousness (to market and rich investors), take your pick, is also fueling the craze. I've picked just one of many reports circulating on Wall Street which predict that Apple can keep on rising like a rocket seemingly ad infinitum (right chart above). It can't. And it won't. Nothing goes up forever especially at the amazing growth rates that Apple's spurt has demonstrated in the last two years.

To be sure,

we have given full credit many times before to the IT industry's now biggest

company. Apple's phenomenal growth has served as an embarrassing mirror

to all those "establishment" companies, like IBM, who ignored consumer

markets, preferring to do business with their peer-shrinking Fortune 500

dinosaurs. They ignored our estimates to the contrary,

such

as, for example, this chart (left), published in 1996, which predicted that

Consumer will be king by 2010, not an enterprise czar (see

Louis

XIX of Armonk).

such

as, for example, this chart (left), published in 1996, which predicted that

Consumer will be king by 2010, not an enterprise czar (see

Louis

XIX of Armonk).

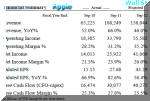

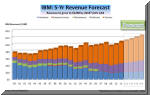

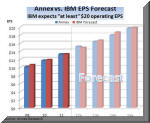

Don't get me wrong. Big Blue has done an outstanding job in its own right. And the $206 record high stock price reflects it. But Apple's earnings are now more than double that of the world's oldest computer company ($33 billion vs. $15.9 billion). So they are not even in the same league anymore. Nor will they be in the future.

We expect IBM to grow at about 2% and 4% over the next two years, while Apple is expected to surge by about 46% and 17% respectively in the same time frame. So the gap will only get wider.

IBM Forecast

Want to k now

something funny? This was supposed to be our IBM five-year forecast Annex

Bulletin. By the time we finished it, however, we realized how

insignificant those numbers are relative to what's going on in the market

these days. So we shifted gears. And "Apple on My Mind" became

the theme of the day.

now

something funny? This was supposed to be our IBM five-year forecast Annex

Bulletin. By the time we finished it, however, we realized how

insignificant those numbers are relative to what's going on in the market

these days. So we shifted gears. And "Apple on My Mind" became

the theme of the day.

Still, for what it's worth, here is what we think will happen with IBM's revenues and earnings through 2015...

Have a nice day.

Happy bargain hunting

Bob Djurdjevic

![]()

Volume XXVIII, Annex Bulletin 2012-04 Bob Djurdjevic, Editor

(c) Copyright 2012 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2012 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

Happy Birthday, IBM! (IBM to turn 100 on June 16; what's the secret of its success?)

Apple Falls from Tree to Cloud, Then to Earth... with a Thud (Last major holdout joins race to cloud, but falls flat on first attempt)

Annex's 33rd Birthday (May 15, 2011)

Big Blue "Rock of Gibraltar" Stands (Analysis of IBM's first quarter business results)

Wall Street's New "Rock of Gibraltar" (Annual update to our 5-yr IBM forecast)

HP: Ghost of EDS Haunts HP (Analysis of HP's first quarter 2011 business results)

Case Makes a Case for Innovation (Analysis of new "Startup America" program)

HP: New Broom Sweeps Clean (Apotheker fills our first prescription in board shake-up)

IBM: Another Phoenix of the IT Industry , Analysis of IBM's 4Q10 result

One Man's Pain, Another Man's Gain? (Analysis of possible impact of Steve Jobs' health on IBM, Intel, other IT companies)

Consumer Rules (Analysis of top 15 global IT leaders' stock and business performances)

IBM Hardware to Rise and Shine Again (Analysis of IBM STG business results and outlook)

BARRON's: IBM Shareholders Will Like New Year (Analysis of Barron's article on IBM stock)

HP's "Stealth CEO" Sounds Bullish in First Public Appearance (Analysis of HP's fourth quarter business results)

Silicon Valley Rodeo (Editorial on shenanigans and costly trivial pursuits)

IBM Business Up, Stock Down (Analysis of Big Blue's third quarter business results)