Annex Bulletin 2012-07 July 17, 2012

A partially OPEN edition

Oracle Runs Out of Oracles (Analysis of latest quarterly results)

INDUSTRY TRENDS

Updated 7/18/12, 8:50AM HST, adds Market Update

Analysis of Market & Business Performances of Top Global IT Companies

Apple Continues to Dominate

Microsoft extends lead over IBM, Google; Facebook bigger than HP, EMS, Dell, Fujitsu...

HAIKU, Maui, July 17, 2012 -

Now that the mid-year earnings

season is upon us, we thought we thought it might be instructive to take

stock of the top IT stocks. Which is what we did today. And the

picture is quite clear: There is Apple and then there are the rest of the

girls. Apple has become so dominant in the IT industry that its stock

performance can shape the trends of all of the top 15 companies combined.

For example,

the aggregate market cap of the top 15 IT global leaders has increased 3.4%

to $1.9 trillion since our last analysis in February (right chart). So

all seems reasonably well despite the recent market "correction." Well,

maybe not so well. Take out Apple from the mix, and the aggregate

market cap is actually DOWN a li ttle

over 3%.

ttle

over 3%.

This trend also holds true in the short term. Take a look at that stock price chart on the left. Apple is the only green light in a sea of red.

If take a look at

the longer-term trends, such as the chart below left, you can see why.

Coming on the

heels of several years of 30% to 40% annual increases, Apple shares have

soared 23% since February, boosting its market cap to a phenomenal $567

billion. That's 30% of the aggregate value of all top 15 IT companies.

As for the rest of the market cap leader, Microsoft, IBM, Google and Oracle maintained their respective positions behind Apple. The largest software company actually extended its lead over IBM and Google despite having the lowest P/E ratio among the top five IT leaders (10.9 vs. Apple's 14.8, IBM's 13.7, Google's 17.5 and Oracle's 15.3).

As for the rate of change, Apple and Oracle were the only companies among the top 15 to show some stock appreciation since February. Dell and HP got killed, declining 34% and 36% respectively. Cisco and EMC also declined in double digits.

Outlook for IBM: Slightly Undervalued

And what does that all mean for IBM on the eve of Big Blue's second quarter earnings release? Ever since we started looking at IBM as part of the group of top 10 IT stocks, the market has been remarkably consistent in the way it treated the Big Blue shares.

Back in April, for example, after the first quarter release, we thought IBM was worth about $200 per share. On Apr 20, the IBM stock was closed at $199.65.

| Table 1 | TOP 10 IT GLOBAL LEADERS | ||||

| Top 10 IT Cos. | Mkt Cap | Trail P/E | Change | Mkt Cap | Trail P/E |

| 17-Jul-12 | (annlzd) | 20-Apr-12 | |||

| Apple | $567.53 | 14.79 | 25% | $534.23 | 14.01 |

| Microsoft | $249.17 | 10.86 | -34% | $272.03 | 9.19 |

| IBM | $211.84 | 13.70 | -34% | $231.27 | 14.93 |

| $188.02 | 17.48 | -12% | $193.90 | 20.90 | |

| Oracle | $146.08 | 15.27 | 7% | $143.68 | 18.01 |

| Cisco | $86.94 | 11.95 | -76% | $107.23 | 16.04 |

| Intel | $127.69 | 10.74 | -30% | $137.97 | 10.79 |

| SAP | $72.54 | 17.04 | -26% | $77.63 | 20.09 |

| EMC | $48.13 | 19.86 | -71% | $58.58 | 23.05 |

| HP | $37.21 | 7.34 | -93% | $48.46 | 8.50 |

| Avg Top 10 IT | $173.52 | 13.90 | -15% | $180.50 | 15.55 |

| IBM stock on 7-17-12 | $183.65 | ||||

| IBM @ Top10 P/E | 2% | $186.44 | $13.41 | (EPS) | |

| IBM stock on 4-20-12 | $199.65 | ||||

| IBM @ Top8 P/E | 0% | $200.07 | |||

| 17-Jul-12 | Source: Annex Research | ||||

So if we now (July 17) take a look at IBM within the group of its top 10 peers, the Big Blue shares appear to be slightly undervalued at the moment ($184 vs. $186). Which means that unless Big Blue springs some downside surprises in its tomorrow's release, there is a small upside potential to its stock price.

Analyst second quarter consensus is a $3.42 EPS on $26.3 billion of revenue for a year-over-year growth of +11% and -1%, respectively. Current full-year consensus EPS is $15.06, in line with management's guidance of $15.00. This results in expected 12% earnings rise in 2012 on $107.5 billion in revenue, up 1% .

So that's the yardstick against which tomorrow's IBM report will measure up.

Market & Business Analysis

Meanwhile, back to

our Top 15 analysis, the newcomer among the Top 15 IT companies - Facebook -

has already claimed the top spot with a P/E ratio of 70. That is, of course, due to its relatively low earnings vs. high Wall Street

expectations. EMC, Yahoo, Google and SAP are also in the same

category, with P/E ratios ranging from 17-20.

of course, due to its relatively low earnings vs. high Wall Street

expectations. EMC, Yahoo, Google and SAP are also in the same

category, with P/E ratios ranging from 17-20.

IBM and Apple are in the middle of the pack, while HP and Dell have the cellar locked up all to themselves with P/E ratios of only 7.34 and 6.92 respectively.

When it comes to

business performances, Apple is now not only the most profita ble

company in the industry, but also the largest in terms of reve

ble

company in the industry, but also the largest in terms of reve nues.

And the company has extended its lead over HP in revenues, and over

Microsoft and IBM in profits.

nues.

And the company has extended its lead over HP in revenues, and over

Microsoft and IBM in profits.

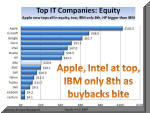

Apple now also tops

the industry in terms of equity. And by a wide margin. Obviously the

industry leader is not into "financial engineering" of its results through

stock buybacks, for example, as many other com panies

are. IBM, the industry's oldest company at 101, might have been expected to

be the equity champion on account of longevity alone.

panies

are. IBM, the industry's oldest company at 101, might have been expected to

be the equity champion on account of longevity alone.

Think again. IBM is only 8th. Why? The company has been selling itself back to the shareholders since 1995. As a result, even the lowly HP is now double the IBM equity size, while EMC is about the same.

So onward and upward once again toward the summertime earnings season...

|

Click here for detailed tables and charts (Annex clients only) |

Happy bargain hunting

Bob Djurdjevic

HAIKU, Maui, June 18 - Forget the left brain. Emotion is everything when it comes to Wall Street. What is happening in the market today is another case in point. Intel delivered inline results. Yet it still faces significant challenges in the future (see Intel Still Has A Device Problem).

Never mind. When investors want to move the market up, they will grasp at straws for a reason. Or no reason at all. As a result, the Dow is up 100 points, as are most of the top IT stocks, except for Apple!? (Go figure, right?)

When reporters would ask me over the years on days like this, just before IBM and others were due to release their latest earnings results, what I expected the market to do, I would usually tell them that I don't do markets.

"That would be like trying to predict the moods of teenage girls," I'd add. And as a father of two girls, I can speak about that from experience.

If they insisted anyway, I would usually tell them that eventually Wall Street tends to get it right. When the emotions settle down again. And so to that extent, it is good to be reminded what we said yesterday about the current valuations of IBM and other top IT global companies (see Table 1 above).

Yesterday, IBM at $184 was slightly undervalued. Today, IBM at $188 is slightly overvalued. I'll leave it to you to figure out what that says about the likely market reaction to IBM's release which is due this afternoon after 4PM New York time.

My guess? Up, up and away. Until collective emotions, like a giant wave, exhausted of energy that created them, crash upon the shores of reality.

![]()

Volume XXVIII, Annex Bulletin 2012-06 Bob Djurdjevic, Editor

(c) Copyright 2012 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2012 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

Happy Birthday, IBM! (IBM to turn 100 on June 16; what's the secret of its success?)

Apple Falls from Tree to Cloud, Then to Earth... with a Thud (Last major holdout joins race to cloud, but falls flat on first attempt)

Annex's 33rd Birthday (May 15, 2011)

Big Blue "Rock of Gibraltar" Stands (Analysis of IBM's first quarter business results)

Wall Street's New "Rock of Gibraltar" (Annual update to our 5-yr IBM forecast)

HP: Ghost of EDS Haunts HP (Analysis of HP's first quarter 2011 business results)

Case Makes a Case for Innovation (Analysis of new "Startup America" program)

HP: New Broom Sweeps Clean (Apotheker fills our first prescription in board shake-up)

IBM: Another Phoenix of the IT Industry , Analysis of IBM's 4Q10 result

One Man's Pain, Another Man's Gain? (Analysis of possible impact of Steve Jobs' health on IBM, Intel, other IT companies)

Consumer Rules (Analysis of top 15 global IT leaders' stock and business performances)

IBM Hardware to Rise and Shine Again (Analysis of IBM STG business results and outlook)

BARRON's: IBM Shareholders Will Like New Year (Analysis of Barron's article on IBM stock)

HP's "Stealth CEO" Sounds Bullish in First Public Appearance (Analysis of HP's fourth quarter business results)

Silicon Valley Rodeo (Editorial on shenanigans and costly trivial pursuits)

IBM Business Up, Stock Down (Analysis of Big Blue's third quarter business results)