Annex Bulletin 2007-26 June 28, 2007

A CONFIDENTIAL client edition

Burning the Track - Firing on all cylinders, Accenture raises forecast [Annex clients click here]

New Broom Sweeps Clean - Analysis of CSC's 4Q07 business results [Annex clients click here]

IT SERVICES

Updated 7/06/07, 1:00PM PDT, adds Market Update 2 - Woes Continue...

Analysis of Accenture's Third Quarter Fiscal 2007 Results

Burning the Track

Accenture Again Firing on All Cylinders, Raises Outlook

INDIANAPOLIS, June 28 - It seems highly

appropriate that we should be reporting on Accenture's third quarter

fiscal 2007 business results from the city that is home to the nation's

most famous car race - "Indianapolis

500." For, the fourth

largest competitor is burning the track in the global IT services

race. Revenues and profits are both up in the latest period, as are

the new contract bookings and cash flow.

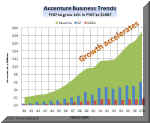

Third quarter revenues surged by 15% to $5 billion, a new third quarter record, while net profit rose by 8% (excluding the 3Q06 write-offs) to $345 million. And the company is firing on all cylinders. All Accenture geographies and all vertical lines of business grew in the quarter, most in double digits. As a result, the company has already surpassed the $19 billion revenue mark at the trailing 12 month-run rate (click on right thumbnail chart to enlarge).

Accenture's

future is also looking bright as new contract bookings soared to $6.2

billion, the second quarterly total in the company's history and the

third consecutive

quarter of record consulting bookings ($3.5 billion - see the left chart).

Accenture's

future is also looking bright as new contract bookings soared to $6.2

billion, the second quarterly total in the company's history and the

third consecutive

quarter of record consulting bookings ($3.5 billion - see the left chart).

But perhaps the sweetest music to Accenture shareholders' ears was its free cash flow which soared to $896 million in the latest quarter. For the full fiscal year, the company expects free cash flow in the $1.9 billion to $2.1 billion range.

No wonder the CEO Bill Green (right photo) boasted about

Accenture's "tremendous cash flow" during the post-earnings

conference with analysts. "We are delivering value to our

clients and to our shareholders," he said in a bit of an

understatement, especially relative to competition.

cash flow" during the post-earnings

conference with analysts. "We are delivering value to our

clients and to our shareholders," he said in a bit of an

understatement, especially relative to competition.

Just to put things in perspective, Accenture's free cash flow is roughly double that of the second largest competitor in the IT services business (EDS; revenues $22.5 billion).

Wall Street Applauds... Tepidly

Accenture also raised its profit outlook for fiscal 2007 to $1.94 to $1.96 earnings per share, up from the previous EPS guidance of $1.88 to $1.93.

No wonder Wall Street also applauded Accenture's latest results, pushing its shares after-hours trading up by about two points to $43.8. The stock has been on a sustained upward march ever since the early March when its third fiscal quarter started (see the chart).

We do not recall attending another earnings call during which a company harvested as many congratulatory comments from the normally stingy analysts as Accenture's leaders did today. In fact, in light of such a shower of accolades from the financial community, only a two-point move in the stock price seems like a tepid reaction to a stellar quarter.

Well, there's always tomorrow, we suppose...

Business Segment Analysis

Geographies.

The Asia/Pacific region has once again been the story of the quarter.  The area is bursting at the seams, it seems. :-) Third quarter

The area is bursting at the seams, it seems. :-) Third quarter

revenues surged to

$457 million, up 44% from the year before (up 37% in local

currency - see the right chart). It was the fifth consecutive

quarter of double digit growth in Asia/Pacific, noted Steve Rohleder,

Accenture's COO (left).

revenues surged to

$457 million, up 44% from the year before (up 37% in local

currency - see the right chart). It was the fifth consecutive

quarter of double digit growth in Asia/Pacific, noted Steve Rohleder,

Accenture's COO (left).

The region's growth "is anchored in Japan and Australia," he noted during the Q&A.

Rohleder added that the boost to business

is coming mostly from the local (Japanese) companies. "There has been a shift to more outsourcing in that

region," he noted.

companies. "There has been a shift to more outsourcing in that

region," he noted.

Meanwhile, Europe continued to occupy the pole position as the company's largest geographic area with revenues of $2.5 billion. That's why it is especially significant that its growth has also been in double digits (up 19% as reported; up 8% in local currency).

Americas' revenues were $2.16 billion in the quarter, up 7% as reported (up 6% in local currency).

Industries.

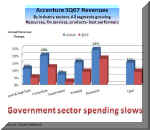

Resources and financial services were the fastest growing industry segments in the third quarter, each soaring by 24% and 20% respectively

(up 18% and up 12% in local currency).

segments in the third quarter, each soaring by 24% and 20% respectively

(up 18% and up 12% in local currency).

Communications & High Tech and "Products"

also grew in  double digits, while the government business - the smallest

of the five industry sectors - rose by 7% (up only 2% in local currency).

double digits, while the government business - the smallest

of the five industry sectors - rose by 7% (up only 2% in local currency).

"We've showed strength across the board," said Pam Craig (left photo), the company's CFO, in her remarks during the teleconference with analysts.

Global Delivery Capability Expanding Rapidly

Accenture's global delivery work force is

expanding at a torrid pace. As of May 31, it was a 63,000-strong

army of IT professionals spread from the Americas, to Eastern Europe, to

India and to the Philippines. That's nearly 40% of the company's

158,000 people. And the growth is unrelenting...

people. And the growth is unrelenting...

In the Americas' region, the global delivery work force has grown by 20%, according to Rohleder, the COO. In India, it is up 48% to about 30,000 people. In the Philippines, it has increased by 50% to about 11,000 employees. Which leaves about 22,000 people for the Americas and Eastern Europe (see the chart).

That is one of the reasons the profit yield from Accenture's new contracts has remained relatively stable even though the size of the average deals has been coming down. Most of the contracts are now in the $100 million to $300 million range, Rohleder noted.

Another reason is the "better pricing" climate, as Green, the CEO, put it. "There are still some sole-sourcing opportunities," he said.

Outlook

As

previously noted, Accenture has raised its outlook for fiscal 2007 EPS to

a range of $1.94 to $1.96. The company also expects the

revenue growth to be close to 12% in local currency, and the new bookings

in the range of $22 billion to $24 billion. In short, the

growth is accelerating (see the right chart).

$1.94 to $1.96. The company also expects the

revenue growth to be close to 12% in local currency, and the new bookings

in the range of $22 billion to $24 billion. In short, the

growth is accelerating (see the right chart).

And

with a free cash flow of between $1.9 billion

and $2.1 billion, Accenture seems poised to deliver another banner

year, when the current fiscal year ends on August 31.

And

with a free cash flow of between $1.9 billion

and $2.1 billion, Accenture seems poised to deliver another banner

year, when the current fiscal year ends on August 31.

"We have a unique worldwide operating model," summed up Green, the CEO. "We believe we will continue to widen our lead" (over the competition).

Judging by the uniform enthusiasm at this evening's teleconference, there seem to be no Doubting Thomas's among the Wall Street analysts that this Green oracle would come true.

|

Click here for detailed Accenture results & forecast table (Annex clients only) |

Happy bargain hunting!

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

INDIANAPOLIS, June 29 - Ah, what a difference a day can make. Or make it a night. Having had the night and a part of the morning to absorb the good third quarter news, investors promptly sold off the Accenture stock despite a generally strong market. Worse, all of Accenture's major competitors' shares were thriving this morning.

As of about 10:30AM EDT, the market was up about 70 points, EDS, CSC, HP, BearingPoint and ACS shares were rising between one and two points, while Accenture's stock declined by over 1.5% for no logical reason that we could discern. And it's not even Friday the 13th.

The only thing we can think of is that maybe Wall Street thinks Accenture has peaked? "It doesn't get better than this?" Well, check out our 2005 report's opening paragraph... (see "A Whopper of a Quarter," Oct 2005), and then take a look at the above charts to see what happened after "it could not get better than this."

Accenture Stock's Woes Continue

SCOTTSDALE, July 6 - Accenture stock's woes have continued in the week since its second quarter earnings announcement (see the charts).

The stock is underperforming not only all of its major competitors' share, but also that of the broader markets. There has been no significant news that we are aware of that would explain this strange reaction by investors to a strong quarter.

Once again, one thing we can think of is that maybe the market thinks the company has peaked. Another explanation could be that the stock had already experience significant appreciation prior to the 2Q earnings announcement after it was added to the Russell Index in mid-June. Either way, it is clear that there is no longer a direct correlation between a company's fundamentals and the market price. And that's true not just for Accenture, but for stock in general.

For additional Annex Research reports, check out... Annex

Bulletin Index 2007 (including all prior years' indexes) Or just click on SEARCH and use "company or topic name" keywords. Volume XXIII, Annex Bulletin

2007-26 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS is part of the Comprehensive Market Service (CMS).

It is intended for the exclusive use

by those who have contracted for the entire CMS service. ![]()

![]()

June 28, 2007

(c) Copyright 2007 by Annex Research, Inc. All rights reserved.

e-mail: annex@djurdjevic.com

Tel/Fax: +1-602-824-8111

Home | Headlines | Annex Bulletins | Index 1993-2007 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

The Last of the (PC) Mohicans - Analysis of Dell's strategy changes; Linux, Wal-Mart

BRIC by BRIC... to Top Line Growth - Echoes from IBM meeting for fin analysts [Annex clients click here]

Per Ardua Ad Astra - Analysis of HP's 2Q07 business results [Annex clients click here]

The Greening of Big Blue (IBM to spend $1 billion on "going green")

Are We in "Buyback Bubble?" - Analysis of corporate stock buyback trends

IBM: Lowering Center of Gravity (Highlights of Partnerworld 2007, with Detailed Reports for Clients)

Growth Accelerating - Analysis of Capgemini's 1Q07 business results [Annex clients click here]

To Buy (back shares) or Not to Buy? - Analysis of stock buybacks in corporate America

No Surprises in Good Opening Quarter - Analysis of IBM 1Q business results [Annex clients click her

IBM Stock Still Grossly Undervalued (A preview of IBM first quarter business results]

Accenture Beats Forecasts, Again (Analysis of Accenture's 2QFY07 results)

HPS, Capgemini Tie for "Gold" - Results of Octathlon 2007 [Annex clients click here]

The Value of pi (π) - Analysis of IBM System p and System i market and product strategies

IBM Profit to Grow Faster Than Revenue - Update to 5-yr IBM forecast [Annex clients click here]

The (T)ides of March Sink Markets Again - Analysis of global economic & investment trends

IGS: Growth Slows, Profit Surges - Analysis of IGS 2006 business results [Annex clients click here]

HP: Toward New Highs? (Excerpts from analysis of HP's 1Q07 business results) [Annex clients click here]

Capgemini Caps Great Year, Saves Best for Last (Analysis of Capgemini's fourth quarter business results)

EDS: On Sunny Side of Street (Analysis of EDS' fourth quarter business results)

CSC: Where Less Seems More (Analysis of CSC's third quarter fiscal 2007 business results)

Fujitsu: Sales Up, Profit Down (Analysis of Fujitsu's third quarter fiscal 2007 business results)

IBM Shatters Records (Analysis of IBM's fourth quarter business results)

IBM Stock Passes Century Mark (Analysis of Big Blue's Stock Performance)

Happy Days Are Here Again (Analysis of Top 20 IT leaders' latest stock market and business performances)

"Excellenture" Excels Again (Analysis of Accenture's first quarter fiscal 2007 business results) [Annex clients click here]

Hedging the Bets (Analysis of latest institutional shareholdings of leading IT companies: IBM, HP, Accenture, EDS, CSC, BearingPoint, ACS, Perot ) [Annex clients click here]

Globalization Accelerates (Analysis of United Nation's annual survey of global investments)

IBM: A $125-Stock? (An update to "From Small Acorns Mighty Oaks Grow")

Capgemini: Longest Sustained Stock Price Rise (An update to "By Leaps and Bounds")

HP: New King of the Hill (Analysis of HP's fourth quarter business results)

IBM: From Little Acorns Mighty Oaks Grow (Analysis of IBM's "State of the Union")

Capgemini: By Leaps and Bounds (Analysis of Capgemini's preliminary third quarter business results)

Fujitsu: Good Performance Gets Better, More Global (Analysis of Fujitsu's first half FY2007 business results)

IBM: A Slam Dunk Quarter (Analysis of IBM third quarter business results)

Accenture's Emphatic Year-end Accents (Analysis of Accenture's fourth quarter results) [Annex clients click here]

IBM: Services in a Box (Analysis of IBM Global Services' Ground-shifting Announcements)

Strong Comeback by IT Stocks in Third Quarter (Analysis of top 20 IT companies' market and business trends)

Stock Buybacks: A Fading Fad (Dell, erstwhile "King of Fluff," suspends its stock buybacks)

Capgemini: Growth Continues (Revenues, net profit up in double digits, margins also improve)

HP Firing on All Cylinders (Stock sets new multi-year record following excellent third fiscal quarter results) [Annex clients click here]

Power of Manpower (While others move to India, Russia... AMD invests in New York, hailing "phenomenal" quality of its labor force)

Ebb Tide Lowers Most Boats (Analysis of EDS' and CSC's latest quarterly results)

IBM Stock Grossly Undervalued? (Analysis of stock market valuations of IBM and its major competitors) [adds latest Fujitsu, Capgemini results]

IBM vs. HP: A Tale of Two Blues (Both companies are doing well in business, but only HP is favored by Wall Street; Big Blue trying to change that now with its new "India Opus") [Annex clients click here]

Go East, Young Man! (A speech delivered in St. Petersburg, Russia, May 25, 2006; click here for slides)

IBM 5-Yr Forecast: Steady As She Goes (Emphasis on quality continued) [Annex clients click here]

Octathlon 2006: Accenture Again Wins "Gold!" (HP gets "Silver," IBM "bronze") [Annex clients click here]

![]()