Annex Bulletin 2007-15 April 17, 2007

A CONFIDENTIAL client edition

IBM Stock Still Grossly Undervalued (A preview of IBM first quarter business results]

Accenture Beats Forecasts, Again (Analysis of Accenture's 2QFY07 results)

IBM FINANCIAL

Updated 4/24/07, 11:00AM PDT, adds IBM ratchets up stock buybacks...

Analysis of IBM First Quarter Business Results

No Big Surprises in Good Opening Quarter

Mainframe, Unix Servers Lift Hardware Profitability; Services Sales Stumble Again; Software Shines

SCOTTSDALE, Apr 17 - "What do you think will be the market reaction? (to IBM's first quarter results)," a reporter asked this writer just before the company's teleconference with analysts this afternoon. "A shrug," was the reply. "Big Blue hit both the earnings and revenue targets but did not exceed either. There were no major disappointments. But there were no spectacular upside surprises, either. So it was a good quarter overall."

IBM CFO's subsequent comments, and the

initial market reaction to the release, were pretty much along the same

lines. Mark Loughridge (CFO) called it "a solid quarter"

during the post-earnings teleconference The IBM stock first moved up

by about a point in after-hours trading, before sliding down by about the

same amount, and then settling to about a half a point loss ($96.50 as of

5:40PM EDT).

IBM first quarter revenues were up 7% to $22 billion, while net earnings jumped 12% to $1.21 per share. Both numbers were pretty much what Wall Street expected (for more on our stock market valuations, check out "IBM Stock Still Grossly Undervalued", Apr 16). But the revenue distribution was the antithesis of last year's first quarter.

Strong Demand in Asia, Europe, Emerging Markets

The demand in Asia/Pacific and Europe outpaced that in the U.S. by a wide margin. Last year, it was the other way around. Yet this is consistent with impressions we have gleaned from customers and independent IT vendors during a recent trip to Asia and Europe.

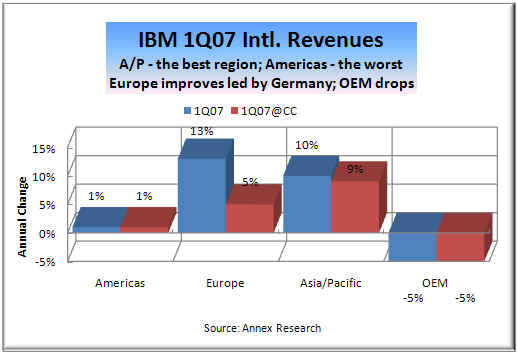

The

Asia/Pacific revenues rose 10% (up 9% in constant currency) to $4.5

billion. The European business was $7.6 billion, up 13% (up 5% in

constant currency). But the company's biggest geographic segment -

the Americas - rose only 1% to $9.1 billion. OEM revenues were $828

million, down 5% compared with a strong 2006 first quarter (see the above

chart).

The

Asia/Pacific revenues rose 10% (up 9% in constant currency) to $4.5

billion. The European business was $7.6 billion, up 13% (up 5% in

constant currency). But the company's biggest geographic segment -

the Americas - rose only 1% to $9.1 billion. OEM revenues were $828

million, down 5% compared with a strong 2006 first quarter (see the above

chart).

These results represent a complete reversal of geographic performances a year ago. The segments that were up last year are down in this quarter and vice versa (click on the thumbnail image for last year's first quarter results). Except for the emerging markets... they stayed strong all around.

Major developing countries, such as China, India, Brazil and Russia, continue to be the engine that's fueling IBM's overall growth. Emerging markets overall are accounting for an increasing share of the company's total revenue increases (they added one point to IBM's growth in this quarter alone). The emerging market revenues were up 24% as reported (up 21% in constant currency), more than three times IBM's overall revenue growth (see above chart).

"It was a spectacular quarter in Asia/Pacific (region)," said Loughridge during a Q&A session that followed his first quarter presentation. IBM management in those countries "did a terrific job," he said.

China topped all other countries with a 34% revenue surge (up 31% in constant currency). India and Brazil also turned in strong performances, while Russia, like the U.S., was a disappointment in this quarter. Its revenues were also up only 1%.

Mainframe, Unix Servers Boost Hardware Performance

HARDWARE.

The mainframe revival (System z, up 12%), now in its second year (seventh

successive quarter of growth), continues to lift IBM hardware revenues, as do the

Unix servers (System p, up 14%). Both product lines are gaining

market share around the world. We can attest as to the strength of

demand for these servers based on this writer's recent 'round the world

trip that included many customer meetings in China and Russia.

quarter of growth), continues to lift IBM hardware revenues, as do the

Unix servers (System p, up 14%). Both product lines are gaining

market share around the world. We can attest as to the strength of

demand for these servers based on this writer's recent 'round the world

trip that included many customer meetings in China and Russia.

The Intel-based servers (System x) also rose as expected (up 7%). But the System i (midrange server) continued its downward spiral (-13%).

System i's "Marketing Weakness." The System i decline was all the more disappointing as the first period of last year was also a down quarter. So it should have been an easy comparison. IBM said the latest drop was due to an "upgrade weakness." But we think the System i suffers from a chronic "marketing weakness."

Based on what we've seen and heard from customers and ISVs around the world, the System i still has the stigma of an old and proprietary system. That, of course, is not true. This IBM midrange server has the underlying technology that's every bit as advanced as anything you will see in the marketplace. And it has an integrated design that "never breaks" and is easy to use.

The fact that there is still such a wide gap between facts and perceptions is a marketing failure. The new Vertical Industry Program that the System i team launched last week is supposed to narrow that gap. That is a step in the right direction. It is aimed at taking the System i back to its roots - the application-driven SMB (small and medium size business) marketplace. IBM hailed it as the product's biggest facelift in nearly 20 years (the AS/400 was launched in June 1988).

The move still leaves a wide price gap at the entry level between the System i and the lower-priced Intel competition which may hamper IBM's revival in its effort to woo new SMB customers. Yet that's where IBM gets most of the System i volume business. Even at the old lowest price of $12,000+, the entry Model 520 accounted for 92% of the unit shipments, according the Mark Shearer, the head of the System i product line.

The System i VIP rescue mission is critical for IBM to be taken seriously as a global SMB vendor (the System i is now a key part of the newly formed SMB division within IBM's Systems and Technology Group [STG] - see "IBM Lowers Center of Gravity," Jan 2007). It had better work.

Distribution, Financial, SMB - Best Sectors

Among the vertical IBM segments, the old stalwart

performers - financial and SMB sectors, also two biggest industry units -

again did very well for IBM, rising 9% each. But this time, they were outdone

by the distribution sector, the only IBM industry to achieve double digit

growth in the quarter (up 10%). Indeed, we have seen many examples

of rapid growth in distribution sector, especially in food or appliance

retailing (see the chart).

very well for IBM, rising 9% each. But this time, they were outdone

by the distribution sector, the only IBM industry to achieve double digit

growth in the quarter (up 10%). Indeed, we have seen many examples

of rapid growth in distribution sector, especially in food or appliance

retailing (see the chart).

Government business increased in line with the overall IBM growth rate (up 7%), while communications and manufacturing ("industry") lagged behind.

It should be noted that what IBM calls SMB often includes large enterprises, especially in overseas market. So the "real SMB" (companies with less than 1,000 employees) is actually quite a bit smaller.

IBM Should Create Market Buzz by Building Up Its SMB

Yet the "real SMB" (or "midmarket" as some call it) is by far the best IT market opportunity, growing at rates of 30%+ in many countries (vs. 9% in IBM's case). And is very profitable for a lot of SMB companies in this business. This is also a potential gold mine of acquisition opportunities for IBM, so "Baby Blue" could grow even faster than the market.

"Baby Blue?" Perhaps you recall our Annex Bulletin from last fall in which we suggested IBM ought to consolidate and break off its SMB operations into a "Baby Blue," and brand it as a separate entity? (but keep 100% ownership). That's because SMB companies prefer to buy from other SMB companies (see "From Little Acorns Might Oaks Grow?", Nov 2006).

Another

piece of that strategy was for IBM to build up its SMB portfolio through

acquisitions. If IBM were to divert only a part of the funds it is

wasting on stock buybacks ($79 billion so far!), from which its business

is getting zero return, can you imagine how many companies Big Blue could

buy? And even if IBM were to shotgun the marketplace (which we do

not recommend), chances are that some of the multi million-pellets would

hit some really great SMB upstarts - the acorns from which mighty oaks

would grow.

Another

piece of that strategy was for IBM to build up its SMB portfolio through

acquisitions. If IBM were to divert only a part of the funds it is

wasting on stock buybacks ($79 billion so far!), from which its business

is getting zero return, can you imagine how many companies Big Blue could

buy? And even if IBM were to shotgun the marketplace (which we do

not recommend), chances are that some of the multi million-pellets would

hit some really great SMB upstarts - the acorns from which mighty oaks

would grow.

And that, almost as much as any other move, could be a way to create sufficient buzz on Wall Street to move the stock up closer to the $125 mark, which we think is currently a fair market price for IBM (see "IBM Stock Still Grossly Undervalued", Apr 16). It would demonstrate that the likes of Steve Jobs or Bill Gates or Larry Page and Sergey Brin (Google co-founders) aren't the only ones able to generate new wealth and buzz in the IT sector.

It remains to be seen if IBM has the courage to do act so boldly and creatively. Before you write the computer giant off as just a "dancing elephant," a mocking name by which its former chairman referred to Big Blue in his book ("Who Says Elephants Can't Dance," by Lou Gerstner, 2002), think again.

Last January, IBM did implement a part of the "Baby Blue" idea when it formed a separate SMB division within Bill Zeitler's hardware group (STG), and put it under Marc Dupaquier, a former IBM software executive. Which in and of itself is significant... it hints at eventual integration of SMB hardware and software (see "IBM Lowers Center of Gravity"). Both are necessary ingredients for a successful SMB vendor.

So let's just wait and see... maybe that $125-stock price isn't as daunting as it seems.

Services Sales Performance Disappoints Again

SERVICES. Meanwhile, back to the first quarter results, the biggest part of IBM - Global Services - is again suffering from an old malaise - slow or no growth. New signings are down 3% to $11.1 billion, while backlog is down $1 billion since the end of the fourth quarter (see the chart).

These

indices are clearly disappointing. They mean that IBM's largest unit

is losing more business than it is winning. Just as the fourth

quarter results were a shot in the arm suggesting a reversal of negative

trends, the latest signings and backlog figures canceled such optimism

(see the charts). And that has to be worrisome in terms of future

growth.

These

indices are clearly disappointing. They mean that IBM's largest unit

is losing more business than it is winning. Just as the fourth

quarter results were a shot in the arm suggesting a reversal of negative

trends, the latest signings and backlog figures canceled such optimism

(see the charts). And that has to be worrisome in terms of future

growth.

What

IBM needs to do with its services business is to shake things up from top

to bottom. We would do it by breaking up the Global Services into a

number of industry-based semi-autonomous units. And then letting

them loose on the marketplace. The demand is there if only IBM gets

out of its own way. Breaking things up would make IBM services

nimbler and bring them closer to customers.

What

IBM needs to do with its services business is to shake things up from top

to bottom. We would do it by breaking up the Global Services into a

number of industry-based semi-autonomous units. And then letting

them loose on the marketplace. The demand is there if only IBM gets

out of its own way. Breaking things up would make IBM services

nimbler and bring them closer to customers.

Meanwhile, the smaller part of IGS - Global Business Services - that accounts for about a third of IBM's services revenues ($4.2 billion), has been doing relatively well. Its revenues are up 9%, and the pretax profit margin has jumped two points (to 10.5%). Consulting is a more profitable service activity for IBM than the bigger Global Technology Services (GTS, $8.3 billion revenues), but a lower (7.8%) pretax margin.

Software Continues to Rake It In, But STG Most Improved

SOFTWARE.

Perhaps the best part of IBM's first quarter

was its software performance, especially that of its branded middleware.

Websphere, Tivoli, Information Management and Rational all grew at more

than double the overall corporate growth rate (between 14% and 20% vs. 7%).

These products are becoming defacto standards in customers future IT

plans. Everywhere we have been overseas lately, CIOs and independent

software developers are installing or considering these IBM application

enablers.

PROFITABILITY. Another reason software was the best part of IBM was its enviable profitability (84% gross margin, 21% pretax margin). In fact, at $1.04 billion pretax profit, IBM software towers over the other lines of business (see the thumbnail chart).

But

the most improved IBM unit in that sense is actually IBM hardware (STG)

whose gross margin surged by nearly three points (to 35%). That's

because the highly profitable mainframe (System z) and Unix servers

(System p) are doing so well that their growth is helping offset the

weaknesses elsewhere in the IBM product line.

But

the most improved IBM unit in that sense is actually IBM hardware (STG)

whose gross margin surged by nearly three points (to 35%). That's

because the highly profitable mainframe (System z) and Unix servers

(System p) are doing so well that their growth is helping offset the

weaknesses elsewhere in the IBM product line.

Outlook

Looking ahead, the IBM CFO acknowledged the need for his company to take some corrective actions to improve the profitability of the GTS business, and that of the sales effectiveness in the U.S.

Loughridge also reiterated IBM's objective of delivering 10% to 12% earnings per share growth for the full year. "Including the gain from the sale of our printer business, we expect our earnings per share growth to be closer to 12%," he said.

"Bottom line, we believe earnings per share growth in 2007 will be in line with our long term objective" (of delivering double digit earnings growth), the IBM CFO summed it up.

And what did Wall Street think of that?

It shrugged. By the end of the evening, the IBM stock was down 0.8% to $96.33. So it goes...

|

Click here for detailed IBM forecast tables and charts (Annex clients only) |

Happy bargain hunting!

Bob Djurdjevic

The Economist: IBM Up for Sale?

SCOTTSDALE, Apr 18 - Forget the talk about the acquisitions IBM should make with all its surplus billions. What if the hunter became the hunted? What if IBM itself were up for grabs?

We know. It sounds far fetched. And it wouldn't worth repeating if the rumor did not come from one of the world's most respected media organizations - the London-based Economist. In its rather comprehensive report on IBM globalization, "Hungry Tiger, Dancing Elephant," Apr 4, 2007, the Economist alluded to just such a possibility:

IBM's share price rose from $11 in March 1993 to $125 in December 2001—a price it has never since matched. Last July it fell below $74, although it rallied after that—perhaps as the message that the firm is taking India seriously started to get through. Having briefly touched $100, it slipped back to $93 during the recent market wobbles. That is not the sort of performance to make a boss feel secure in his job, especially in this era of trigger-happy boards. (Though, if rumours are to be believed, a record-breaking bid from private equity may yet rescue Mr Palmisano's reputation.)

(bold italics added by Annex Research)

If such a thing were even remotely possible, it would have to be indeed a whopper of a takeover bid. So far, the biggest private equity deal ever done was Blackstone Group's buyout of Equity Office Properties, the largest U.S. real estate holder after the federal government. The deal was worth $38.9 billion. It closed on February 7 of this year.

The price comprised of $23 billion in cash and $15.9 billion of debt. It eclipsed the previous record buyouts, including a $33 billion takeover of HCA health care provider last November by a consortium including Bain and Kohlberg Kravis Roberts. Blackstone Group is a private investment fund co-founded by Peter Peterson and Stephen Schwarzman.

Now, keeping the above in mind, consider what it would take to buy an IBM. Even at its current (we think undervalued) price of $94.70 (yes, the stock is down another 2.5% this morning), IBM is worth $143 billion. We think a fair market price for it is $125 per share, a 32% premium. That would put Big Blue's price tag at $187.5 billion - five times bigger than the biggest private equity deal ever done!

Who's got that kind of money lying

around? Even the treasuries of developed countries would find it hard to scrape that much spare cash together, let alone

private equity funds. So sorry, Economist editors. Even with

your stellar reputation, one cannot help but wonder what you had inhaled

the day this story came out. Or was it just an April Fool's Day

joke? After all, the publication date was only three days

later... :-)

would find it hard to scrape that much spare cash together, let alone

private equity funds. So sorry, Economist editors. Even with

your stellar reputation, one cannot help but wonder what you had inhaled

the day this story came out. Or was it just an April Fool's Day

joke? After all, the publication date was only three days

later... :-)

But we did like your story's art... and that's no "elephant in a china shop"-joke.

IBM Ratchets Up Stock Buybacks, Dividends

SCOTTSDALE, Apr 24 - The IBM

Board ratcheted up its stock buybacks today by earmarking another $15 billion for it. Including the

remaining balance at the end of March from prior authorizations, IBM has

now about $16.4 billion available for share repurchases. Big Blue

said in a release that it "may complete a substantial portion of the

repurchases over the next several months." Since 1995, IBM has

spent more than $79 billion on stock buybacks (see the chart).

earmarking another $15 billion for it. Including the

remaining balance at the end of March from prior authorizations, IBM has

now about $16.4 billion available for share repurchases. Big Blue

said in a release that it "may complete a substantial portion of the

repurchases over the next several months." Since 1995, IBM has

spent more than $79 billion on stock buybacks (see the chart).

But what really boggles one's mind, however, is that IBM

plans to borrow a large portion of the funds for this repurchase. Borrow the money to pay the

shareholders? O tempora o mores... The only winners we can see in

this type of a deal are the bankers. Some of them may be also IBM

shareholders (see the chart). So it's a win-win deal for them.

funds for this repurchase. Borrow the money to pay the

shareholders? O tempora o mores... The only winners we can see in

this type of a deal are the bankers. Some of them may be also IBM

shareholders (see the chart). So it's a win-win deal for them.

Jesse Greene, IBM treasurer, defended the idea of borrowing the money to buy back the shares. Speaking in an interview today, he said IBM is doing it because "the interest rates are still relatively low," and because "IBM has lots of unused borrowing power."

But credit agency Fitch Ratings said today that it may downgrade its rating on IBM because of this move. What worries Fitch is not only that the new stock buybacks are more than double the IBM historical levels, but the very issue that also stymied us - that a substantial portion will be funded with debt.

But any downgrade is likely to be limited to one notch in the near term, Fitch said. It currently rates IBM at "AA-minus," the fourth-highest investment grade.

Asked about why everybody is so infatuated with stock buybacks in the first place, the IBM treasurer Greene said that it was because they provide a company more flexibility than the dividends.

"Dividends are a one-way trip," he said. "With stock buybacks, we can decide when and how much money we want to return to shareholders."

Speaking of which, the company also boosted its dividend by 33% to $0.40 per share. This was the 12th consecutive year that IBM has increased its quarterly cash dividend. And that's a good thing. For, it rewards all shareholders, not just those willing the sell their shares to the company (such as with stock buybacks).

Obviously, both moves are intended to bolster the IBM stock, which is still grossly undervalued, in our opinion (see "No Big Surprises in Good Opening Quarter," Apr 17, and "IBM Stock Still Grossly Undervalued", Apr 16). Wall Street reacted favorably, pushing the IBM stock up by over four points to just under $100.

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

For additional Annex Research reports, check out... Annex

Bulletin Index 2007 (including all prior years' indexes) Or just click on SEARCH and use "company or topic name" keywords.![]()

![]()

Volume XXIII, Annex Bulletin

2007-15 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS is part of the Comprehensive Market Service (CMS). It is intended for the exclusive use by those who have contracted for the entire CMS service. |

Home | Headlines | Annex Bulletins | Index 1993-2007 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

HPS, Capgemini Tie for "Gold" - Results of Octathlon 2007 [Annex clients click here]

The Value of pi (π) - Analysis of IBM System p and System i market and product strategies

IBM Profit to Grow Faster Than Revenue - Update to 5-yr IBM forecast [Annex clients click here]

The (T)ides of March Sink Markets Again - Analysis of global economic & investment trends

IGS: Growth Slows, Profit Surges - Analysis of IGS 2006 business results [Annex clients click here]

HP: Toward New Highs? (Excerpts from analysis of HP's first quarter FY07 business results) [Annex clients click here]

Capgemini Caps Great Year, Saves Best for Last (Analysis of Capgemini's fourth quarter business results)

EDS: On Sunny Side of Street (Analysis of EDS' fourth quarter business results & turnaround, Act II)

CSC: Where Less Seems More (Analysis of CSC's third quarter fiscal 2007 business results)

Fujitsu: Sales Up, Profit Down (Analysis of Fujitsu's third quarter fiscal 2007 business results)

IBM Shatters Records (Analysis of IBM's fourth quarter business results)

IBM Stock Passes Century Mark (Analysis of Big Blue's Stock Performance)

Happy Days Are Here Again (Analysis of Top 20 IT leaders' latest stock market and business performances)

"Excellenture" Excels Again (Analysis of Accenture's first quarter fiscal 2007 business results) [Annex clients click here]

Hedging the Bets (Analysis of latest institutional shareholdings of leading IT companies: IBM, HP, Accenture, EDS, CSC, BearingPoint, ACS, Perot ) [Annex clients click here]

Globalization Accelerates (Analysis of United Nation's annual survey of global investments)

IBM: A $125-Stock? (An update to "From Small Acorns Mighty Oaks Grow")

Capgemini: Longest Sustained Stock Price Rise (An update to "By Leaps and Bounds")

HP: New King of the Hill (Analysis of HP's fourth quarter business results)

IBM: From Little Acorns Mighty Oaks Grow (Analysis of IBM's "State of the Union")

Capgemini: By Leaps and Bounds (Analysis of Capgemini's preliminary third quarter business results)

Fujitsu: Good Performance Gets Better, More Global (Analysis of Fujitsu's first half FY2007 business results)

IBM: A Slam Dunk Quarter (Analysis of IBM third quarter business results)

Accenture's Emphatic Year-end Accents (Analysis of Accenture's fourth quarter results) [Annex clients click here]

IBM: Services in a Box (Analysis of IBM Global Services' Ground-shifting Announcements)

Strong Comeback by IT Stocks in Third Quarter (Analysis of top 20 IT companies' market and business trends)

Stock Buybacks: A Fading Fad (Dell, erstwhile "King of Fluff," suspends its stock buybacks)

Capgemini: Growth Continues (Revenues, net profit up in double digits, margins also improve)

HP Firing on All Cylinders (Stock sets new multi-year record following excellent third fiscal quarter results) [Annex clients click here]

Power of Manpower (While others move to India, Russia... AMD invests in New York, hailing "phenomenal" quality of its labor force)

Ebb Tide Lowers Most Boats (Analysis of EDS' and CSC's latest quarterly results)

IBM Stock Grossly Undervalued? (Analysis of stock market valuations of IBM and its major competitors) [adds latest Fujitsu, Capgemini results]

IBM vs. HP: A Tale of Two Blues (Both companies are doing well in business, but only HP is favored by Wall Street; Big Blue trying to change that now with its new "India Opus") [Annex clients click here]

Go East, Young Man! (A speech delivered in St. Petersburg, Russia, May 25, 2006; click here for slides)

IBM 5-Yr Forecast: Steady As She Goes (Emphasis on quality continued) [Annex clients click here]

Octathlon 2006: Accenture Again Wins "Gold!" (HP gets "Silver," IBM "bronze") [Annex clients click here]

![]()