Annex Bulletin 2007-08 March 1, 2007

A CONFIDENTIAL client edition

HP: Toward New Highs? (Excerpts from analysis of HP's first quarter FY07 business results) [Annex clients click here]

Capgemini Caps Great Year, Saves Best for Last (Analysis of Capgemini's fourth quarter business results)

IT SERVICES

Updated 3/01/07, 8:30PM MST, updates GBS

Analysis of IBM Global Services 2006 Business Results

Growth Slows, Profit Surges

Strong Finish in New Contract Signings Not Enough to Bolster Revenue Growth

SCOTTSDALE, Mar 1 - While others in the global IT

services arena were looking up, IBM Global Services' (IGS) leaders clearly

had their sights set last year on the bottom line. IGS 2006 revenues

inched up by less than 2%  from

2005 to $48.2 billion, but its gross profit increased by 8% to $13.3

billion (left chart), pretax profit surged by 48% to $5 billion, and net

earnings soared by 60% to $3.6 billion, according to our just-completed

analysis of its last year's results.

from

2005 to $48.2 billion, but its gross profit increased by 8% to $13.3

billion (left chart), pretax profit surged by 48% to $5 billion, and net

earnings soared by 60% to $3.6 billion, according to our just-completed

analysis of its last year's results.

Nevertheless, even after such a remarkable profit improvement, IGS's contribution to the IBM bottom line lags that of software, for example, IBM's most profitable business segment. In 2006, IGS accounted for 53% of IBM revenues, but only for 38% of its pretax profit (right chart). Software, on the other hand, contributed 20% to Big Blue revenues and 41% to its pretax earnings.

Growth Challenges

The most worrisome aspect, however, of the world's largest

IT services company remains its  now

chronic lack of growth. Long gone are the heady years of the 1990s

and their double digit growth rates (right chart) that led us to call this

IBM unit a "crown jewel." In the first six years of the

new millennium, IGS' "organic" revenues (without the PwCC acquisition)

have grown at an average rate of only 4% per year. And

things are getting worse. In the last two years, IGS' revenues have

risen only about 2% per year. That's well below the industry average

or the growth rates of some of the major competitors.

now

chronic lack of growth. Long gone are the heady years of the 1990s

and their double digit growth rates (right chart) that led us to call this

IBM unit a "crown jewel." In the first six years of the

new millennium, IGS' "organic" revenues (without the PwCC acquisition)

have grown at an average rate of only 4% per year. And

things are getting worse. In the last two years, IGS' revenues have

risen only about 2% per year. That's well below the industry average

or the growth rates of some of the major competitors.

What is the reason for this? Well, one is IGS' enormous size.

Big

Size. At $48 billion of revenues (see left chart), IBM's services

unit is more than double the size of its next largest competitor (EDS at

$21 billion). And everybody knows that large creatures are harder to

grow than the smaller ones. So splitting it up (along the industry

lines) would have given it a better chance to grow. [That's a "no

brainer" idea for our longtime clients. We first noted it as an

"amoeba syndrome" in reference to EDS back in 1993 (Annex

Bulletin 93-16, 3/18/93). We also recommended it to IBM back

in 1996 (see "Break

Up IBM," Mar 1996].

Big

Size. At $48 billion of revenues (see left chart), IBM's services

unit is more than double the size of its next largest competitor (EDS at

$21 billion). And everybody knows that large creatures are harder to

grow than the smaller ones. So splitting it up (along the industry

lines) would have given it a better chance to grow. [That's a "no

brainer" idea for our longtime clients. We first noted it as an

"amoeba syndrome" in reference to EDS back in 1993 (Annex

Bulletin 93-16, 3/18/93). We also recommended it to IBM back

in 1996 (see "Break

Up IBM," Mar 1996].

Alas, IBM management has steadfastly refused to do it,

although the company did take a step in that direction when it broke up IGS in 2005 into two units along horizontal lines. Global

Technical Services (GTS, $32 billion) and Global Business Services (GBS,

$16 billion), the two units that emerged from the break-up, grew 3% and

0.4% respectively in 2006.

up IGS in 2005 into two units along horizontal lines. Global

Technical Services (GTS, $32 billion) and Global Business Services (GBS,

$16 billion), the two units that emerged from the break-up, grew 3% and

0.4% respectively in 2006.

GTS, which accounts for about two-thirds of IGS, is the part of the business that encompasses slow growth sub-segments, such as outsourcing, integration and maintenance, but also the fastest growing sub-segment - Business Process Outsourcing (BPO) - which surged 17% last year (see the chart and the P&L table below for details). Unfortunately for IBM, BPO accounts for only 4% of IGS revenues.

As for GBS, which consists of the former PwCC consultants as well as IBM's own, well... its revenue was virtually flat in 2006. This is in stark contrast to Accenture's consulting business, for example, which outpaced its outsourcing in the latest quarter and for the year (see "Excellenture" Excels Again," Dec 2006). So IBM's GBS could certainly use a shot in the arm when it comes to growth, even by way of acquisitions.

"Rescoping."

The second major reason for IGS' lackluster growth has been the

"rescoping." The term originally emerged in 2002 when IBM

first fessed up about being forced by customers to renegotiate some

already closed contracts (red bars on left chart). That, plus the

normal expiries and cancellations, has represented an enormous drain on

IGS' backlog, which has been essentially stagnant in the last five years

(right). And without a rising backlog, there cannot be faster

revenue growth.

"Rescoping."

The second major reason for IGS' lackluster growth has been the

"rescoping." The term originally emerged in 2002 when IBM

first fessed up about being forced by customers to renegotiate some

already closed contracts (red bars on left chart). That, plus the

normal expiries and cancellations, has represented an enormous drain on

IGS' backlog, which has been essentially stagnant in the last five years

(right). And without a rising backlog, there cannot be faster

revenue growth.

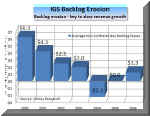

That

point becomes painfully obvious from the "Backlog Erosion" chart

(left). At the start of the current decade, IBM sold on average $6.3

billion dollars more in new contracts than it had lost from the backlog by

way of expiries, cancellations or rescoping. As the decade

progressed, that surplus kept dwindling down until in 2004, it became a

deficit of $2.3 billion. After basically treading water in 2005,

last year was actually the first encouraging one, as IGS returned back to

surpluses of new contracts over average losses.

That

point becomes painfully obvious from the "Backlog Erosion" chart

(left). At the start of the current decade, IBM sold on average $6.3

billion dollars more in new contracts than it had lost from the backlog by

way of expiries, cancellations or rescoping. As the decade

progressed, that surplus kept dwindling down until in 2004, it became a

deficit of $2.3 billion. After basically treading water in 2005,

last year was actually the first encouraging one, as IGS returned back to

surpluses of new contracts over average losses.

The negative effect of IGS' stagnant backlog (right chart)

on the revenue growth is

the revenue growth is  evident

from the left chart. Without the PwCC acquisition in 2002, the

backlog and the revenue lines would be almost parallel. From that,

one can also deduce the reason we have been saying for the last four years

that, in order to grow at or above industry rates, IGS will not only have

to split up, but also supplement its organic growth by acquisitions (see "Save,

Spend and Split," May 2003).

evident

from the left chart. Without the PwCC acquisition in 2002, the

backlog and the revenue lines would be almost parallel. From that,

one can also deduce the reason we have been saying for the last four years

that, in order to grow at or above industry rates, IGS will not only have

to split up, but also supplement its organic growth by acquisitions (see "Save,

Spend and Split," May 2003).

Acquisitions.

Alas,

except for a few small moves, that suggestion has also fallen on deaf ears

at Armonk. And now that EDS is also on a prowl for promising

acquisitions with its war chest of $3 billion this year alone (see "EDS

Turnaround, Act II," Feb 2007), finding and buying IT companies

that would bolster IGS's growth will be that much more challenging.

Competitiveness. Speaking of EDS, Ron Rittenmeyer, EDS' new COO, talked a lot at a recent conference in New York about the company's past successes, especially in 2006. He flashed a slide (right) that showed how successful EDS has been against its four major competitions - IBM Global Services, Accenture, HP Services and CSC. The slide shows EDS allegedly winning 60% of the time when facing IBM in megadeals.

Perhaps sharpening its pencil when competing for business and improving its win rates could be another way of boosting the IGS growth rates. That seems especially prudent now that the company has improved its profitability dramatically through offshoring and other cost cuts.

Of course, a close collaboration with IBM's software unit that has led to the development and announcement of the IBM "service products" (see "IBM: Services in a Box," Sep 2006), is an excellent way of boosting both IGS revenues and profits.

SMB Anyone? Finally, there is one huge market place in which IGS does not appear to be a factor. At least that's the impression one gets after perusing its financials. And that's the small and medium size business market. We feel that this is a growth opportunity - through acquisitions and indigenously - that IGS may be missing, to its ultimate detriment. We have seen recently how some other parts of IBM have taken steps to get more aggressive in this fast growing market (see "IBM Lowers Its Center of Gravity, Forms New SMB Division," Jan 2007). If IGS gets tired of losing market share, perhaps that's the part of the market place to which it may also turn for additional sources of revenues and profits.

Outlook

If IGS plays its cards right, even without any major

acquisitions, we expect it to surpass the $50 billion-mark in 2007. Our forecast implies about a 5%

aggregate revenue growth, with some sub-segments, such as BPO, for

example, continuing to grow in double digits.

the $50 billion-mark in 2007. Our forecast implies about a 5%

aggregate revenue growth, with some sub-segments, such as BPO, for

example, continuing to grow in double digits.

We also expect to see IBM's accelerated expansion into India continuing to yield cost savings and performance benefits to IGS customers which will be reflected in improved profitability for IBM. Of course, many other companies are also well enroute their "Passage to India," so IBM must not overplay its hand on something that's as volatile as labor force. So hedging its bets and spreading the workloads to other emerging markets would be a smart play.

In the end, success or failure in the IT services market often depend on how nimble a vendor is. Companies that like to talk about "adaptive" or "agile" enterprises and "business process transformations" would do well to take some of their own medicine. In IBM's case, that would mean splitting up IGS into smaller semi-autonomous entities by the various industry groups that they serve. This may not only help improve the growth rates, but also the quality of the services the company delivers.

|

Click here for detailed IGS business segment P&Ls (Annex clients only) |

Happy bargain hunting!

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

For additional Annex Research reports, check out... Annex

Bulletin Index 2007 (including all prior years' indexes) Or just click on SEARCH and use "company or topic name" keywords.![]()

![]()

Volume XXIII, Annex Bulletin

2007-08 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS is part of the Comprehensive Market Service (CMS). It is intended for the exclusive use by those who have contracted for the entire CMS service. |

Home | Headlines | Annex Bulletins | Index 1993-2007 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

EDS: On Sunny Side of Street (Analysis of EDS' fourth quarter business results & turnaround, Act II)

CSC: Where Less Seems More (Analysis of CSC's third quarter fiscal 2007 business results)

Fujitsu: Sales Up, Profit Down (Analysis of Fujitsu's third quarter fiscal 2007 business results)

IBM Shatters Records (Analysis of IBM's fourth quarter business results)

IBM Stock Passes Century Mark (Analysis of Big Blue's Stock Performance)

Happy Days Are Here Again (Analysis of Top 20 IT leaders' latest stock market and business performances)

"Excellenture" Excels Again (Analysis of Accenture's first quarter fiscal 2007 business results) [Annex clients click here]

Hedging the Bets (Analysis of latest institutional shareholdings of leading IT companies: IBM, HP, Accenture, EDS, CSC, BearingPoint, ACS, Perot ) [Annex clients click here]

Globalization Accelerates (Analysis of United Nation's annual survey of global investments)

IBM: A $125-Stock? (An update to "From Small Acorns Mighty Oaks Grow")

Capgemini: Longest Sustained Stock Price Rise (An update to "By Leaps and Bounds")

HP: New King of the Hill (Analysis of HP's fourth quarter business results)

IBM: From Little Acorns Mighty Oaks Grow (Analysis of IBM's "State of the Union")

Capgemini: By Leaps and Bounds (Analysis of Capgemini's preliminary third quarter business results)

Fujitsu: Good Performance Gets Better, More Global (Analysis of Fujitsu's first half FY2007 business results)

IBM: A Slam Dunk Quarter (Analysis of IBM third quarter business results)

Accenture's Emphatic Year-end Accents (Analysis of Accenture's fourth quarter results) [Annex clients click here]

IBM: Services in a Box (Analysis of IBM Global Services' Ground-shifting Announcements)

Strong Comeback by IT Stocks in Third Quarter (Analysis of top 20 IT companies' market and business trends)

Stock Buybacks: A Fading Fad (Dell, erstwhile "King of Fluff," suspends its stock buybacks)

Capgemini: Growth Continues (Revenues, net profit up in double digits, margins also improve)

HP Firing on All Cylinders (Stock sets new multi-year record following excellent third fiscal quarter results) [Annex clients click here]

Power of Manpower (While others move to India, Russia... AMD invests in New York, hailing "phenomenal" quality of its labor force)

Ebb Tide Lowers Most Boats (Analysis of EDS' and CSC's latest quarterly results)

IBM Stock Grossly Undervalued? (Analysis of stock market valuations of IBM and its major competitors) [adds latest Fujitsu, Capgemini results]

IBM vs. HP: A Tale of Two Blues (Both companies are doing well in business, but only HP is favored by Wall Street; Big Blue trying to change that now with its new "India Opus") [Annex clients click here]

Go East, Young Man! (A speech delivered in St. Petersburg, Russia, May 25, 2006; click here for slides)

IBM 5-Yr Forecast: Steady As She Goes (Emphasis on quality continued) [Annex clients click here]

Octathlon 2006: Accenture Again Wins "Gold!" (HP gets "Silver," IBM "bronze") [Annex clients click here]

![]()