Annex Bulletin 2007-36 October 16, 2007

A CONFIDENTIAL client edition

On the Button Again - Analysis of IBM 3Q07 results [Annex clients click here]

Seedlings Sprouting Stronger Limbs - Update to "IBM State of the Union" [Annex clients click here]

IBM FINANCIAL

Updated 10/16/07, 7:50PM PDT

Analysis of IBM's Third Quarter Business Results

On the Button Again

Services Exceed Expectations, But Financial Sector, Mainframe and High-end Software Disappoint

SCOTTSDALE, Oct 16 - IBM hit the third quarter numbers on the button again (in line with Wall Street's expectations), but the financial services sector, mainframe and high-end software growth slowdowns disappointed analysts and investors. As a result, the IBM stock gave up in after-hours trading most of the gains it had accumulated earlier in the day in anticipation of a better third quarter.

After dropping by as much as 2%, IBM shares stabilized around $118 in after-hours trading, down 1.3% from their today's closing price of $119.6 (see the chart).

IBM earnings were up 6% to $1.68, a tad higher than the $1.67 Wall Street had expected, while revenues hit the average analyst estimates on the nose at $24.1 billion, up 7% from the year before.

Asia/Pacific Continues to Grow Fastest

Geographies.

The

Americas revenue growth was 3%, same as the U.S. market. IBM cited the weakness in Financial Services sector as the main reason for its

relatively slow growth. Europe had a slightly better performance, rising 11%

as reported, and 4% in constant currency. Germany and Spain turned in

the best results.

cited the weakness in Financial Services sector as the main reason for its

relatively slow growth. Europe had a slightly better performance, rising 11%

as reported, and 4% in constant currency. Germany and Spain turned in

the best results.

Asia/Pacific again had the best performance at constant currency, up 9%

as reported and 6% at constant currency. India, ASEAN, China and

Australia, New Zealand all made

"solid

contributions," according to IBM. Japan's revenue, at

approximately a half of A/P business, was essentially flat.

"solid

contributions," according to IBM. Japan's revenue, at

approximately a half of A/P business, was essentially flat.

Emerging markets are leading the growth in the global economies, IBM said. The combined BRIC countries (Brazil, Russia, India and China) revenues grew 19% as reported and 10% in constant currency. Three of the four countries continued very strong growth, but Brazil declined in the period in constant currency.

Strong Services Growth

Services.

Offsetting some hardware

and software disappointments were the stronger-than-expected IBM Global

Services growth rates. The GTS (Global Technology Services -

mostly outsourcing) revenues were up 13%, while its profits rose 26%.

The GBS (Global Business Services - mostly consulting) business

performed even better. Its re venues

were up 16%, while profits surged by 29%.

venues

were up 16%, while profits surged by 29%.

Both increases, which the IBM CFO, Mark Loughridge characterized as

"exceptional services performance" during a teleconference with analysts,

were due mostly to the strong new contract signings in 2006 and in the first

half of 2007, he explained. Especially big was the fourth quarter of last year, when IBM closed $17.8

billion of new business, its best sales performance since 4Q02.

Especially big was the fourth quarter of last year, when IBM closed $17.8

billion of new business, its best sales performance since 4Q02.

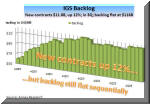

The third quarter 2007 new contract bookings came in about expected at $11.8 billion, up 12% from a year ago, but the corresponding amount of losses due to "rescoping," expirations and cancellations left the backlog sequentially flat at $116 billion.

What should further moderate enthusiasm about IBM's services outlook in the future is not just the huge mountain of new contract signings that the company will have to scale in the current quarter, just to stay flat with a big final period of 2006, but also continued high rates of outflow from its backlog. For the first nine months of 2007, average outflows have equaled the inflows of new contracts ($11.5 billion each). Which suggests flattening of revenue growth in the future, even without the possible derogatory impact of the credit crunch on IT spending of the financial services sector.

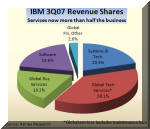

Furthermore, despite a relative improvement in the services'

profitability, the strong services revenue growth ironically helped drag down the overall IBM

profitability (by 0.7 of a point). How is that possible? Well, the

metrics of the services business are such that they carry lower gross

margins that the IBM average (23% to 30% vs. 41% to 42%). And

considering that services now account for more than half of Big Blue's total

revenues, they are the driving force behind Battleship IBM.

services revenue growth ironically helped drag down the overall IBM

profitability (by 0.7 of a point). How is that possible? Well, the

metrics of the services business are such that they carry lower gross

margins that the IBM average (23% to 30% vs. 41% to 42%). And

considering that services now account for more than half of Big Blue's total

revenues, they are the driving force behind Battleship IBM.

So the best thing IBM should to do offset the negative effects of its services resurgence is to boost its highly profitable software growth.

Slower Software Growth, Lower Margins

Software: Alas, IBM software's profitability has also come under pressure in the third quarter. Gross margins are down 1.1 points from a year ago. But at 84.2%, this Big Blue segment is still hugely profitable. That is why a slowdown in its revenue growth rates has been particularly unwelcome at this time when IBM could have used a boost.

Loughridge blamed several large deals, particularly in the financial sector, that had slipped into the fourth quarter. As a result, software revenues were $4.7 billion, an increase of only 7% (3% in constant currency) from a year ago. Just how much of a slowdown that was can be seen from the relative growth rates of various IBM software segments.

Revenues from IBM's middleware products, for example, such as WebSphere, Information Management, Tivoli, Lotus and Rational, were $3.6 billion, up 6% from the third quarter of 2006. They grew by 12% a year ago, double the current growth rate. Operating systems revenues (564 million) dropped 2% (vs. down 6% a year ago).

As for the individual software brands, WebSphere revenues increased 10% (vs. 30% a year ago). Information Management software was up 9% (vs. 12% a year ago). Tivoli infrastructure management software rose 5% (vs. 44% a year ago) Lotus software, which is more ubiquitously used in SMB as well as large enterprise accounts, increased 9% (vs. 8% a year ago). Rational software, integrated tools to improve the processes of software development, was up 3% (vs. 2% a year ago).

Slowing Mainframe Demand, Financial Sector Woes

Hardware: We figure that the lower growth rates of the IBM software brands are probably related to a slowdown in mainframe demand. After all, mainframes pulls over $14 billion in revenues for IBM, almost five times the actual hardware server sales. And slowed the System z revenues did in the third quarter - down 31% as reported and down 34% in constant currency. MIPS shipments also dropped by 21% since a year ago.

IBM blamed a "tough compare" (mainframe revenues surged by 25% in last year's third quarter) and the weak sales in September, again decisions being delayed, especially in the financial sector that consumes about half of the IBM mainframe shipments. IBM's CFO said that 70% of the deferred deals occurred in the financial sector, especially in the U.S.

The good news for IBM is that the profitability of most of its servers, including the mainframe, actually improved, according to Loughridge.

Given that the financial services sector was

uncharacteristically the poorest performing segment of the six (up only 1% in constant currency), and that they are big

consumers of both mainframes and enterprise-class software, there is at

least a hint that the credit crunch may have affected the demand in the

third quarter. So the fourth quarter will be the tell-tale sign of that.

For, IBM will no longer have the excuse that a number of large transactions

did not close on time, as Loughridge kept repeating this evening.

segment of the six (up only 1% in constant currency), and that they are big

consumers of both mainframes and enterprise-class software, there is at

least a hint that the credit crunch may have affected the demand in the

third quarter. So the fourth quarter will be the tell-tale sign of that.

For, IBM will no longer have the excuse that a number of large transactions

did not close on time, as Loughridge kept repeating this evening.

Other IBM servers turned in a mixed performance. The System p continued to excel despite a generally shrinking Unix market, rising 6% in the latest quarter. The System x similarly turned in excellent results under adverse circumstances, rising 6% while awaiting deliveries of Intel's first quad processors. The System i disappointments continued. This product's revenues were down 21%. The high-end of this product line will be merging with the System p, thus easing the pain at least in a financial sense.

Microelectronics revenue also declined (by 15%), while storage products' rose slightly (up 1%). But the Engineering and Technical Services returned to growth (up 10%), in part due to its major win at Nokia Siemens Networks (see "Seedlings Sprouting Stronger Limbs", Oct 2007). Similarly, Retail Store Solutions, a unit that we called in the above report "one of IBM's best kept secrets," is continuing with its explosive growth, surging by 29% in the latest period.

"Hardware did not meet our expectations," Loughridge summed it up. "We are disappointed with the third quarter results."

Summary

Overall, however, it was a good quarter for IBM, right on the money as far as Wall Street expectations are concerned. But some of the above disappointments may negatively affect the IBM stock that had risen in anticipation of strong third quarter results. Furthermore, a possibility that the financial credit crisis may spread and affect IBM's high end results is also likely to be on the back of investors' minds.

As if anticipating such worries, the IBM CFO tried to assure the analysts that the company expects to meet the average of earnings per share estimates on the Street for the fourth quarter of a 15% growth. Loughridge said that analysts' full year estimates were "consistent with our full-year objectives."

Which means $6.91 per share earnings on revenues of $97.4 billion. Our own estimate is pretty close to that - $6.82 EPS and $97.2 billion revenues. So we'll see if the universe unfolds as it should in the fourth quarter.

|

For a detailed IBM 3Q07 P&L, click here; for a Pretax table, click here |

Happy bargain hunting!

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

![]()

For additional Annex Research reports, check out... Annex Bulletin Index 2007 (including all prior years' indexes)

![]()

Or just click on SEARCH and use "company or topic name" keywords.

Volume XXIII, Annex

Bulletin 2007-36 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS is part of the Comprehensive Market Service (CMS). It is intended for the exclusive use by those who have contracted for the entire CMS service. |

Home | Headlines | Annex Bulletins | Index 1993-2007 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

An Apple a day keeps bear away (Analysis of Top 20 IT companies' market, business performances )

Profitable Growth Continues - Analysis of HP's 3Q business results [Annex clients click here]

zAAP-ed by IBM! (Analysis: Mainframe demand benefiting from specialty engines, Java)

Profitable Growth Continues - Analysis of HP's 3Q business results [Annex clients click here]

Sun's Solaris to Shine on IBM's Polaris (IBM to offer Suns OS on its hardware)

The Greening of Big Blue, Part 2 (IBM to save $250M in mainframe consolidation)

IBM Beats the Street (Analysis of IBM 2Q07 business results)

Adios, Microsoft Vista! (How I Failed Twice in Trying to Scale Mt. Vista)

Burning the Track - Firing on all cylinders, Accenture raises forecast [Annex clients click here]

New Broom Sweeps Clean - Analysis of CSC's 4Q07 business results [Annex clients click here]

The Last of the (PC) Mohicans - Analysis of Dell's strategy changes; Linux, Wal-Mart

BRIC by BRIC... to Top Line Growth - Echoes from IBM meeting for fin analysts [Annex clients click here]

Per Ardua Ad Astra - Analysis of HP's 2Q07 business results [Annex clients click here]

The Greening of Big Blue (IBM to spend $1 billion on "going green")

Are We in "Buyback Bubble?" - Analysis of corporate stock buyback trends

IBM: Lowering Center of Gravity (Highlights of Partnerworld 2007, with Detailed Reports for Clients)

Growth Accelerating - Analysis of Capgemini's 1Q07 business results [Annex clients click here]

To Buy (back shares) or Not to Buy? - Analysis of stock buybacks in corporate America

No Surprises in Good Opening Quarter - Analysis of IBM 1Q business results [Annex clients click her

IBM Stock Still Grossly Undervalued (A preview of IBM first quarter business results]

Accenture Beats Forecasts, Again (Analysis of Accenture's 2QFY07 results)

HPS, Capgemini Tie for "Gold" - Results of Octathlon 2007 [Annex clients click here]

The Value of pi (π) - Analysis of IBM System p and System i market and product strategies

IBM Profit to Grow Faster Than Revenue - Update to 5-yr IBM forecast [Annex clients click here]

The (T)ides of March Sink Markets Again - Analysis of global economic & investment trends

IGS: Growth Slows, Profit Surges - Analysis of IGS 2006 business results [Annex clients click here]

HP: Toward New Highs? (Excerpts from analysis of HP's 1Q07 business results) [Annex clients click here]

Capgemini Caps Great Year, Saves Best for Last (Analysis of Capgemini's fourth quarter business results)

EDS: On Sunny Side of Street (Analysis of EDS' fourth quarter business results)

CSC: Where Less Seems More (Analysis of CSC's third quarter fiscal 2007 business results)

Fujitsu: Sales Up, Profit Down (Analysis of Fujitsu's third quarter fiscal 2007 business results)

IBM Shatters Records (Analysis of IBM's fourth quarter business results)

IBM Stock Passes Century Mark (Analysis of Big Blue's Stock Performance)

Happy Days Are Here Again (Analysis of Top 20 IT leaders' latest stock market and business performances)

"Excellenture" Excels Again (Analysis of Accenture's first quarter fiscal 2007 business results) [Annex clients click here]

Hedging the Bets (Analysis of latest institutional shareholdings of leading IT companies: IBM, HP, Accenture, EDS, CSC, BearingPoint, ACS, Perot ) [Annex clients click here]

Globalization Accelerates (Analysis of United Nation's annual survey of global investments)

IBM: A $125-Stock? (An update to "From Small Acorns Mighty Oaks Grow")

Capgemini: Longest Sustained Stock Price Rise (An update to "By Leaps and Bounds")

HP: New King of the Hill (Analysis of HP's fourth quarter business results)

IBM: From Little Acorns Mighty Oaks Grow (Analysis of IBM's "State of the Union")

Capgemini: By Leaps and Bounds (Analysis of Capgemini's preliminary third quarter business results)

Fujitsu: Good Performance Gets Better, More Global (Analysis of Fujitsu's first half FY2007 business results)

IBM: A Slam Dunk Quarter (Analysis of IBM third quarter business results)

Accenture's Emphatic Year-end Accents (Analysis of Accenture's fourth quarter results) [Annex clients click here]

IBM: Services in a Box (Analysis of IBM Global Services' Ground-shifting Announcements)

Strong Comeback by IT Stocks in Third Quarter (Analysis of top 20 IT companies' market and business trends)

Stock Buybacks: A Fading Fad (Dell, erstwhile "King of Fluff," suspends its stock buybacks)

Capgemini: Growth Continues (Revenues, net profit up in double digits, margins also improve)

HP Firing on All Cylinders (Stock sets new multi-year record following excellent third fiscal quarter results) [Annex clients click here]

Power of Manpower (While others move to India, Russia... AMD invests in New York, hailing "phenomenal" quality of its labor force)

Ebb Tide Lowers Most Boats (Analysis of EDS' and CSC's latest quarterly results)

IBM Stock Grossly Undervalued? (Analysis of stock market valuations of IBM and its major competitors) [adds latest Fujitsu, Capgemini results]

IBM vs. HP: A Tale of Two Blues (Both companies are doing well in business, but only HP is favored by Wall Street; Big Blue trying to change that now with its new "India Opus") [Annex clients click here]

Go East, Young Man! (A speech delivered in St. Petersburg, Russia, May 25, 2006; click here for slides)

IBM 5-Yr Forecast: Steady As She Goes (Emphasis on quality continued) [Annex clients click here]

Octathlon 2006: Accenture Again Wins "Gold!" (HP gets "Silver," IBM "bronze") [Annex clients click here]

![]()