Annex Bulletin 2007-28 July 18, 2007

A partially OPEN CLIENT edition

IBM Beats the Street (Analysis of IBM 2Q07 business results)

Adios, Microsoft Vista! (How I Failed Twice in Trying to Scale Mt. Vista)

IBM FINANCIAL

Updated 7/19/07, 2:20AM PDT, adds Humongous Stock Buybacks...

Analysis of IBM Second Quarter Business Results

IBM Beats the Street

Big Blue Exceeds Both Revenue and Profit Expectations, Lifts Growth Monkey off CEO's Back

MUMBAI, India, July 19 (July 18 PDT) - Sam

Palmisano has finally gotten the growth monkey off his back.

trying to rev up its top line, Big Blue has finally done it. It

removed the bane of slow growth from its critics' agenda. Revenues

were up 9% to $23.8 billion, with IBM's biggest and most profitable

business segments growing in double digits. Earnings per share grew

even faster, rising 15% from a year ago.

trying to rev up its top line, Big Blue has finally done it. It

removed the bane of slow growth from its critics' agenda. Revenues

were up 9% to $23.8 billion, with IBM's biggest and most profitable

business segments growing in double digits. Earnings per share grew

even faster, rising 15% from a year ago.

IBM's CFO, Mark Loughridge, sounded like a football coach

who won the Super Bowl and

then showed up for a post-game press conference.

"This was really a great quarter," said Loughridge in conclusion of an hour-long teleconference with analysts. "Every CFO waits for a quarter like this."

More jubilant than boastful, Loughridge sounded proud of his team achievements, even congratulating the Big Blue U.S. team as the "most improved" part of the company at one point of the teleconference.

Sure, there were some minor weaknesses in the latest quarterly, but they pale in comparison to the strength that IBM's major engines of showed. One would have to look hard and be really nitpicky to find them. Which we will do in a moment. But first, the big picture...

Gathering Momentum

It takes a long time to turn a huge ship around and gather up speed. Now that IBM has done it and has the growth momentum, it is likely to carry it forward for some time to come. And that has got to bode well for its stock as well. After-hour traders recognized that, as they pushed Big Blue shares up four points to about $115.

Ever since a year ago, when the IBM shares were trading at about $74 per share, we have been saying that the IBM stock was grossly undervalued (see "Grossly Undervalued," July 2006). We have restated that last fall (see "A $125 Stock," Nov 2006), and again this past April (see "IBM Stock Still Grossly Undervalued," Apr 2007). Well, it appears that the market is finally getting the message. The IBM shares have climbed a long way from $74 toward that $125-mark, at which we think the company may be fairly valued relative to its competitors' shares.

As a result, IBM lifted its year-end 2007 revenue forecast by a point to 14% to 15%.

Strong Overseas Performance

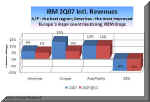

Geographies. Strength

in overseas market topped the slower U.S. growth. Asia/Pacific again had the best performance with 10 percent growth, led by India,

Southeast Asia and a steady recovery in Japan.

again had the best performance with 10 percent growth, led by India,

Southeast Asia and a steady recovery in Japan.

Still, at a 6% revenue increase, the largest IBM geographic region (Americas at $10.1 billion) now also has a bounce to its walk.

IBM revenue in Europe rose 13% to $8.2 billion, while sales in the Asia/Pacific region rose 10% to $4.6 billion. Most major countries performed well, including Spain, the UK, and Italy.

Emerging Markets.

The company's overall growth was underpinned by soaring sales in

emerging markets (up 32%; up 25% at constant currency). Among the

four BRIC countries (Brazil, Russia, India, China, Russia), Russia took

the pole position in this quarter with a 52% revenue jump. India and China were also strong,

rising 34% and 45% respectively. Brazil was up 21%.

quarter with a 52% revenue jump. India and China were also strong,

rising 34% and 45% respectively. Brazil was up 21%.

These countries now represent five of IBM’s revenue and contribute one point of growth to IBM's total. IBM CFO Loughridge said the company's objective is to double the revenue growth from these countries over the next four years.

Rapid

growth and seemingly unbounded optimism were also evident in this

writer's discussions with local customers and IT companies here in

India. IT is the bursting at the seams in this land of a billion

people and has become the talk of the town. Which means that the

country that was once blamed for taking away American jobs, such as

during the 2004 presidential campaign, for example, is now being

celebrated as one of the global growth pillars for U.S.-based

multinationals. (The photo shows the financial district in Mumbai,

India).

Rapid

growth and seemingly unbounded optimism were also evident in this

writer's discussions with local customers and IT companies here in

India. IT is the bursting at the seams in this land of a billion

people and has become the talk of the town. Which means that the

country that was once blamed for taking away American jobs, such as

during the 2004 presidential campaign, for example, is now being

celebrated as one of the global growth pillars for U.S.-based

multinationals. (The photo shows the financial district in Mumbai,

India).

As if to underscore this point, Loughridge said, "we are beating the local (Indian) competition on their own turf." IBM is now the largest IT services provider in India, he added, citing an independent research source.

Business Segment Analysis

As we have also pointed out before, it was just a matter of time before the stock market gave IBM credit for its improved fundamentals, and for Palmisano's stressing quality over quantity in his business strategy (see "Quality over Quantity", Mar 2005 and "IBM 5-Yr Forecast: Steady As She Goes", Apr 2006). Nowhere is that more apparent than in Big Blue's software business.

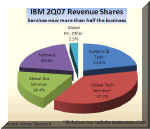

Software.

IBM's most profitable part of the business - software - generated

double digit growth (up 13%) in the quarter. With three of its major brands

growing in the 20%-plus range, the company is cleaning up at the top of

its middleware portfolio. Websphere revenue was up 28%, Tivoli was

up 33%, Information Management up 21%. Lotus and Rational also

grew in low double digits.

growth (up 13%) in the quarter. With three of its major brands

growing in the 20%-plus range, the company is cleaning up at the top of

its middleware portfolio. Websphere revenue was up 28%, Tivoli was

up 33%, Information Management up 21%. Lotus and Rational also

grew in low double digits.

In the aggregate, all five major brands surged by 23%. As these five key brands now represent more than half (53%) of IBM's software business, they have become the driving force behind the company's growth in profits and revenues.

Services.

Finally, there is something to cheer about in IBM's biggest business

segment - IBM Global Services (IGS). Investors will also be buoyed by the fact

that even this relative growth laggard in recent years also grew in double

digits (up 10%) in the latest quarter. Both Global Technology

Services (GTS) and Global Business Services (GBS) contributed to that

growth, making it a balanced performance.

IBM Global Services (IGS). Investors will also be buoyed by the fact

that even this relative growth laggard in recent years also grew in double

digits (up 10%) in the latest quarter. Both Global Technology

Services (GTS) and Global Business Services (GBS) contributed to that

growth, making it a balanced performance.

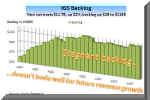

The future also looks bright, as the company closed $11.7 billion in new contract signings in the second quarter, up 22% from a year ago. But this is also an area in which we saw one of the few blemishes in the company's latest quarterly results.

IBM CFO boasted that, "the best

customer is the one you've already got," proudly  pointing out the

fact that most of the new business has come from existing customers.

But we find that a little troubling, especially considering IGS'

relatively stagnant backlog (left chart). Most successful businesses

grow

from the bottom. That means winning new customers in addition to

expanding the existing relationships. The fact that IGS

has being going back to the same old large company trough from which it

has been feeding for years suggests that the small and medium (SMB)

portion of its business isn't doing so well.

pointing out the

fact that most of the new business has come from existing customers.

But we find that a little troubling, especially considering IGS'

relatively stagnant backlog (left chart). Most successful businesses

grow

from the bottom. That means winning new customers in addition to

expanding the existing relationships. The fact that IGS

has being going back to the same old large company trough from which it

has been feeding for years suggests that the small and medium (SMB)

portion of its business isn't doing so well.

Industries.

This concern seems to be also supported by the tepid growth that the IBM SMB segment showed overall. It was only fourth in terms of growth

out of the six vertical segments that IBM reports (see the chart).

SMB segment showed overall. It was only fourth in terms of growth

out of the six vertical segments that IBM reports (see the chart).

If the company is sustain its growth momentum over a longer time frame, it will have to start winning new logos, both in the services business and overall. And that's where SMB comes in, one of the Big Blue seedlings we talked about last fall (see "IBM: From Little Acorns Mighty Oaks Grow," Nov 2006).

Hardware. Hardware was the only relatively weak part of the second quarter results. Its total revenues of $5.1 billion were up 2% from a year ago (flat, adjusting for currency). The weakness was mostly due to a decline in its chip business and gaming consoles. But hardware profit grew 77%, adding 2.6 points to the gross margin.

The System p (UNIX) server revenues rose 7%, while the System x servers jumped 16%. Revenues from System z server products increased 4%, while the System i servers declined 15%. Overall, IBM systems business was up 7%.

Mainframe strength continued for the fifth consecutive quarter. Revenues were up for the fifth consecutive quarter, while the System z MIPS shipments were up 45%, for the eighth consecutive quarter.

"If you look at the MIPS on specialty engines they grew over 130%, reflecting the mainframe’s ability to virtualize and consolidate different workloads," Loughridge said. "Linux MIPS grew over 80 percent, Java and Database MIPS each grew over 100 percent."

Storage revenues rose 6%, while Microelectronics business, which includes the gaming consoles, decreased 9%. But as IBM pointed out, this business accounts for only 1% of its gross profit.

IBM's stock buybacks went from huge to

humongous in the second quarter. At $14.6 billion, they dwarfed all

other quarters in the 12-year history of this dubious squandering  of

capital, including the highest previous quarter (1Q07) - by more than

three-fold (left chart). In the aggregate, IBM has now spent about

$94 billion on share repurchases.

of

capital, including the highest previous quarter (1Q07) - by more than

three-fold (left chart). In the aggregate, IBM has now spent about

$94 billion on share repurchases.

Since the latest round of stock

buybacks included $12.5 billion executed through share repurchase

agreements in May that involved taking out loans to finance them, IBM's debt has now jumped by

53%, from $22.7 billion to $34.7 billion (right chart).

involved taking out loans to finance them, IBM's debt has now jumped by

53%, from $22.7 billion to $34.7 billion (right chart).

At the same time, its shareholders' equity slumped by 41%, from $28.5 billion at the end of 2006, to $16.8 billion as of June 30. Add to it that what IBM did was sort of shady or clever, take your pick (the IRS closed the tax loophole IBM used to pull off this scheme in early June - see the Wall Street Journal story "IBM's Under-the-Wire Tax Break", June 7, available by subscription), and you'll see that it's not a pretty picture.

In the complex deal, that the Journal first reported on May 30, IBM created a Netherlands unit to finance the stock repurchase with overseas earnings and avoid having to repatriate funds, which would make them subject to higher U.S. taxes.

Outlook

As

the IBM CFO pointed out, his company seems to be firing on nearly all

cylinders. Bac k

in May, he and the IBM CEO Palmisano showed the Wall Street

k

in May, he and the IBM CEO Palmisano showed the Wall Street  analysts

a "roadmap" to an ambitious 2010 earnings per share of $11, up

from $6.06 last year (see

"BRIC

by BRIC... to Top Line Growth," May 2007).

Now it appears that the first part of that journey - the 2007 fiscal year

- is likely to produce faster than anticipated growth.

analysts

a "roadmap" to an ambitious 2010 earnings per share of $11, up

from $6.06 last year (see

"BRIC

by BRIC... to Top Line Growth," May 2007).

Now it appears that the first part of that journey - the 2007 fiscal year

- is likely to produce faster than anticipated growth.

on

$23.1 billion in revenue.

on

$23.1 billion in revenue.

So the better-than-expected second quarter revenue and profit was Big Blue's first step toward achieving its lofty 2010 EPS goal (see the chart).

"We’ve made our first installment toward our $11 per share goal for 2010," said Loughridge in conclusion of his prepared remarks during the teleconference with analysts.

|

Click here for detailed IBM P&L & pretax tables (Annex clients only) |

Happy bargain hunting!

Bob Djurdjevic

![]() Click

here for PDF (print) version

Click

here for PDF (print) version

For additional Annex Research reports, check out... Annex

Bulletin Index 2007 (including all prior years' indexes) Or just click on SEARCH and use "company or topic name" keywords. Volume XXIII, Annex Bulletin

2007-28 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale, Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS is part of the Comprehensive Market Service (CMS).

It is intended for the exclusive use

by those who have contracted for the entire CMS service. ![]()

![]()

July 18, 2007

(c) Copyright 2007 by Annex Research, Inc. All rights reserved.

e-mail: annex@djurdjevic.com

Tel/Fax: +1-602-824-8111

Home | Headlines | Annex Bulletins | Index 1993-2007 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

Burning the Track - Firing on all cylinders, Accenture raises forecast [Annex clients click here]

New Broom Sweeps Clean - Analysis of CSC's 4Q07 business results [Annex clients click here]

The Last of the (PC) Mohicans - Analysis of Dell's strategy changes; Linux, Wal-Mart

BRIC by BRIC... to Top Line Growth - Echoes from IBM meeting for fin analysts [Annex clients click here]

Per Ardua Ad Astra - Analysis of HP's 2Q07 business results [Annex clients click here]

The Greening of Big Blue - IBM to spend $1 billion on "going green"

Are We in "Buyback Bubble?" - Analysis of corporate stock buyback trends

IBM: Lowering Center of Gravity - Highlights of Partnerworld 2007, with Detailed Reports for clients

Growth Accelerating - Analysis of Capgemini's 1Q07 business results [Annex clients click here]

To Buy (back shares) or Not to Buy? - Analysis of stock buybacks in corporate America

No Surprises in Good Opening Quarter - Analysis of IBM 1Q business results [Annex clients click here]

IBM Stock Still Grossly Undervalued (A preview of IBM first quarter business results]

Accenture Beats Forecasts, Again (Analysis of Accenture's 2QFY07 results)

HPS, Capgemini Tie for "Gold" - Results of Octathlon 2007 [Annex clients click here]

The Value of pi (π) - Analysis of IBM System p and System i market and product strategies

IBM Profit to Grow Faster Than Revenue - Update to 5-yr IBM forecast [Annex clients click here]

The (T)ides of March Sink Markets Again - Analysis of global economic & investment trends

IGS: Growth Slows, Profit Surges - Analysis of IGS 2006 business results [Annex clients click here]

HP: Toward New Highs? (Excerpts from analysis of HP's 1Q07 business results) [Annex clients click here]

Capgemini Caps Great Year, Saves Best for Last (Analysis of Capgemini's fourth quarter business results)

EDS: On Sunny Side of Street (Analysis of EDS' fourth quarter business results)

CSC: Where Less Seems More (Analysis of CSC's third quarter fiscal 2007 business results)

Fujitsu: Sales Up, Profit Down (Analysis of Fujitsu's third quarter fiscal 2007 business results)

IBM Shatters Records (Analysis of IBM's fourth quarter business results)

IBM Stock Passes Century Mark (Analysis of Big Blue's Stock Performance)

Happy Days Are Here Again (Analysis of Top 20 IT leaders' latest stock market and business performances)

"Excellenture" Excels Again (Analysis of Accenture's first quarter fiscal 2007 business results) [Annex clients click here]

Hedging the Bets (Analysis of latest institutional shareholdings of leading IT companies: IBM, HP, Accenture, EDS, CSC, BearingPoint, ACS, Perot ) [Annex clients click here]

Globalization Accelerates (Analysis of United Nation's annual survey of global investments)

IBM: A $125-Stock? (An update to "From Small Acorns Mighty Oaks Grow")

Capgemini: Longest Sustained Stock Price Rise (An update to "By Leaps and Bounds")

HP: New King of the Hill (Analysis of HP's fourth quarter business results)

IBM: From Little Acorns Mighty Oaks Grow (Analysis of IBM's "State of the Union")

Capgemini: By Leaps and Bounds (Analysis of Capgemini's preliminary third quarter business results)

Fujitsu: Good Performance Gets Better, More Global (Analysis of Fujitsu's first half FY2007 business results)

IBM: A Slam Dunk Quarter (Analysis of IBM third quarter business results)

Accenture's Emphatic Year-end Accents (Analysis of Accenture's fourth quarter results) [Annex clients click here]

IBM: Services in a Box (Analysis of IBM Global Services' Ground-shifting Announcements)

Strong Comeback by IT Stocks in Third Quarter (Analysis of top 20 IT companies' market and business trends)

Stock Buybacks: A Fading Fad (Dell, erstwhile "King of Fluff," suspends its stock buybacks)

Capgemini: Growth Continues (Revenues, net profit up in double digits, margins also improve)

HP Firing on All Cylinders (Stock sets new multi-year record following excellent third fiscal quarter results) [Annex clients click here]

Power of Manpower (While others move to India, Russia... AMD invests in New York, hailing "phenomenal" quality of its labor force)

Ebb Tide Lowers Most Boats (Analysis of EDS' and CSC's latest quarterly results)

IBM Stock Grossly Undervalued? (Analysis of stock market valuations of IBM and its major competitors) [adds latest Fujitsu, Capgemini results]

IBM vs. HP: A Tale of Two Blues (Both companies are doing well in business, but only HP is favored by Wall Street; Big Blue trying to change that now with its new "India Opus") [Annex clients click here]

Go East, Young Man! (A speech delivered in St. Petersburg, Russia, May 25, 2006; click here for slides)

IBM 5-Yr Forecast: Steady As She Goes (Emphasis on quality continued) [Annex clients click here]

Octathlon 2006: Accenture Again Wins "Gold!" (HP gets "Silver," IBM "bronze") [Annex clients click here]

![]()