Annex Bulletin 2013-01 January 20, 2013

A partially OPEN edition

Apple Falls from Treetop (Analysis of latest market and business results of top 15 IT companies)

INDUSTRY TRENDS

Updated 1/23/13, 7:42PM HST, adds MARKET UPDATE: Apple Drops Even Lower...

Analysis of Market & Business Performances of Top Global IT Companies

Apple Falls from Treetop

Google leapfrogs over IBM, Microsoft to #2 spot in market cap;

Cisco, SAP, Yahoo, Google best performers in second half of 2012; What will the 4Q earnings crop bring? Wishful thinking fuels stock price increases

HAIKU, Maui, Jan 20, 2013 - "What goes up, must come down," is an adage older than Wall Street. Every once in a while, the stock market gets to see it in action. In the second half of 2012, Apple fell from the treetop to which it had climbed so precipitously in the last several years.

To be sure, Apple is still by far the world's most valuable IT company with $470 billion in market cap. That's more than double the value of the next two biggest rivals - Google and Microsoft. But it's also a far cry from the dizzying heights of about $660 billion Apple was worth in mid-September.

Meanwhile, Google has been coming on strong in the second half of 2012. The company has now leapfrogged over IBM and Microsoft to reclaim the #2 spot in the industry in terms of market cap. Since our last report in July on the Top 15 global IT companies' stock and business performances, Accenture has also moved up ahead of HP and Yahoo jumped over Dell.

But it

terms of the market cap change, it was Cisco, SAP, Yahoo and Google - in

that order - that led the parade of top performers in the last six months.

It is not often that one gets to see Apple at a bottom of any industry

charts. But if you look at the above one that shows us the rate of change in

market cap, you will find Apple and Intel in th cellar, having dropped about

17% each during this time period.

Considering the huge losses HP announced in the 4Q12 (see HP: Duped, Down and Out?), and the general demise of that stock over the last two years, one might find perhaps more than a little surprising to see that in December, that company's stock outperformed most of its major rivals, while Apple's did the worst (right chart).

Which reminds us of the question we asked almost a year ago: How long can Apple's stock market leadership last? Here's what we said in a story "Is Apple Killing the Goose That Laid the Golden Egg?" (see 2-09-12 Annex Bulletin):

...While the iPhone is making Apple richer than God, it is also killing the companies that sell it - the telecoms (see Apple iPhone Success Strangles Profits At Sprint, AT&T, Verizon). Sprint, for example, just announced a loss of $1.3 billion, widening the red ink from a year ago by a considerable margin. AT&T and Verizon are also losing money on their best selling product. Worse, because the iPhone is a hog when it comes to data transfers, it is forcing the telephone companies to spend even more money to expand the bandwidth of their networks.

So this may be the classic case of Apple "killing the goose that laid the golden egg." Which begs the question: How long can Apple's leadership last?

Well, we now know the answer to the latter question: It lasted till Sep 2012. That's when Apple started to fall from the Wall Street treetop.

Business Performance

When it comes to business fundamentals, however, Apple is still looking as shiny as ever. Its $42 billion net profit roughly equals the combined earnings of the three next largest competitors - IBM, Microsoft and Intel.

But Apple's rate of growth is slowing as is its revenue growth.

It has now dropped into single digits for the first time in eons. And it is now reportedly losing share in the mobile phone market to its archrival Samsung. Changing of the guard again at the royal IT palace...

Meanwhile, Google, Facebook and SAP are spurting in terms of growth. Dell, HP and IBM are the laggards holed up in up the cellar of the top 15 chart.

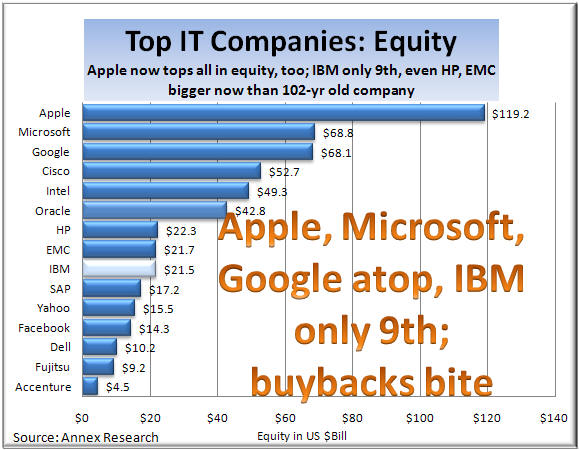

Finally, in terms of shareholders' equity, it is not a small paradox that the industry's oldest company, a 102-year old IBM, is now only 9th. Meanwhile, Apple, Microsoft and Google - all relative upstarts - dominate the top of the equity chart. The reason, of course, is the buybacks. IBM have been buying back its own shares aggressively for the last 17 years. And its equity, or lack thereof, shows it. Not that other IT leaders haven't been doing it as well. But none have been at it for as long and by as much as the Big Blue.

Fourth Quarter Earnings Outlook

This coming week will kick off the fourth quarter earnings harvest for most of the leading IT companies. They say picture is worth a thousand words. Here's out picture of the post-release outlook for the top four global IT companies that are expecting to report their latest business results this week:

| 4Q12 EARNINGS SEASON OUTLOOK | |||||||

| Average Estimates | 4Q12 | 1Q13 | 2012 | Release | Outlook | ||

| Date | |||||||

| IBM Revenues | 29.09 | 24.72 | 104.33 |

|

|||

| Change (year/est) | -1.30% | 0.20% | -2.40% | ||||

| EPS | 5.25 | 3.03 | 15.13 | ||||

| Change (year/est) | 11.46% | 8.99% | 12.57% | ||||

| Year Ago EPS | 4.71 | 2.78 | 13.44 | ||||

|

|||||||

| Apple Revenues | 54.7 | 46.01 | 190.19 | 1-23-13 | |||

| Change (year/est) | 18.10% | 17.40% | 21.50% | ||||

| EPS | 13.41 | 11.84 | 48.22 | ||||

| Change (year/est) | -3.32% | -3.74% | 9.22% | ||||

| Year ago EPS | 13.87 | 12.3 | 44.15 | ||||

|

|||||||

| Google Revenues | 12.27 | 12.12 | 41.45 | 1-22-13 | |||

| Change (year/est) | 50.90% | 49.00% | 42.50% | ||||

| EPS | 10.54 | 10.61 | 39.77 | ||||

| Change (year/est) | 10.95% | 5.26% | 10.35% | ||||

| Year Ago EPS | 9.5 | 10.08 | 36.04 | ||||

| Microsoft Revenues | 21.56 | 20.73 | 79.84 |

|

|||

| Change (year/est) | 3.30% | 19.10% | 8.30% | ||||

| EPS | 0.75 | 0.78 | 2.86 | ||||

| Change (year/est) | -3.85% | 30.00% | 4.76% | ||||

| Year Ago EPS | 0.78 | 0.6 | 2.73 | ||||

The shading of colors is supposed to portray the likely intensity of market reactions and the rate of stock price change after the 4Q announcements. So stand by and see how things turn out...

Wishful Thinking Fueled Stock Increases; Market Poised for a Fall?

Meanwhile, there is something else we observed when analyzing the stock market performances of the top 15 IT companies. During the last six months, the single most important factor in the rise of some stock prices has been wishful thinking.

How so? Well, the P/E ratios are going through the roof. Even if we disregard Facebook's 164 P/E, or HP's which is practically infinity (since the company lost nearly $13 billion last year), the P/E's of the remaining top 9 IT companies have gone up by 7% since July. Which is roughly by how much the Dow has increased since then, too (up 6.5%).

In other words, the recent rise in the stock market appears to be fueled by wishful thinking rather than by increased profits or some other sort of tangible business gain. And when that happens, amber caution lights tend to start flashing in this analyst's head. For what it's worth...

|

Click here for detailed table (PDF) |

Happy bargain hunting

Bob Djurdjevic

Apple Drops Even Lower

HAIKU, Maui, Jan 23 - In this weekend's analysis of the top 15 global IT companies, we noted that the treetop walker Apple had already been humbled by the market prior to its today's earnings release (Apple Drops from Treetop). Well, after its latest results were unveiled, Apple dropped even further down the tree. No, make that plummeted much closer to earth than it had been in years:

After Hours : 463.49No surprise there, based on our weekend expectations. The applause that greeted Google's results last night and the surge in that company's stock price also came on cue. The only surprise so far has been Wall Street's exuberance over the average IBM results.

Meanwhile, back to Apple, the stock tumbled 10% after reporting the slowest profit growth since 2003, and the weakest sales increase in 14 quarters. Revenues rose 18 percent to $54.5 billion, but fell short of $54.9 billion, the average analyst estimate. Earnings were basically flat.

IBM looked invincible for several decades, Microsoft for over 10 years. Apple's reign atop the IT industry lasted three years. It's becoming harder to stay on top than to claw your way to the summit...

Which bodes well for customers. For, more frequent changing of the guard at the top is a good indicator how tough the competition in the IT industry has become, and how much innovation cycles have shortened.

![]()

Volume XXIX, Annex Bulletin 2013-01 Bob Djurdjevic, Editor

(c) Copyright 2013 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2013 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

HP: Duped, Down and Out? (Analysis of HP's business and stock results)

Same Old Story, New Numbers Underscore Lack of IBM Growth (Analysis of IBM's third quarter business results)

Lack of Growth: IBM's Achilles Heel (Analysis of IBM's 2Q12 business results)

Apple Continues to Dominate (Analysis of top global IT companies' market and business results)

Big Blue Feet of Clay (Analysis of IBM first quarter results and long-term forecast)

Wall Street in Love! (No Signs of Caution on Ides of March, IBM Forecast Overshadowed by Wall Street Action)

Waning of PC Era Hurts HP (Analysis of latest HP business results)

Apple Leaves Everybody in Dust (Analysis of latest market and business results of top 15 IT companies)

Apple, IBM Clean Up, Google Stumbles (Analysis of fourth quarter business results of five major IT companies - Apple, IBM, Microsoft, Intel and Google)